Frencken’s H2 net profit down 20.7% to S$20.4 million; numbers show recovery from H1 despite tech downturn

SEMICONDUCTOR and machine manufacturer Frencken Group posted a 20.7 per cent decrease in its net profit for the half year ended Dec 31, 2023 to S$20.4 million from S$25.7 million in the corresponding period a year earlier.

Revenue for the half year decreased 1.3 per cent to S$391.8 million from S$397.2 million in H2 2022, said the group in a bourse filing on Tuesday (Feb 27).

For the full financial year, revenue came in 5.5 per cent lower than FY2022, dropping to S$742.9 million from S$786.1 million, while net profit plummeted 37.4 per cent to S$32.5 million from S$51.9 million.

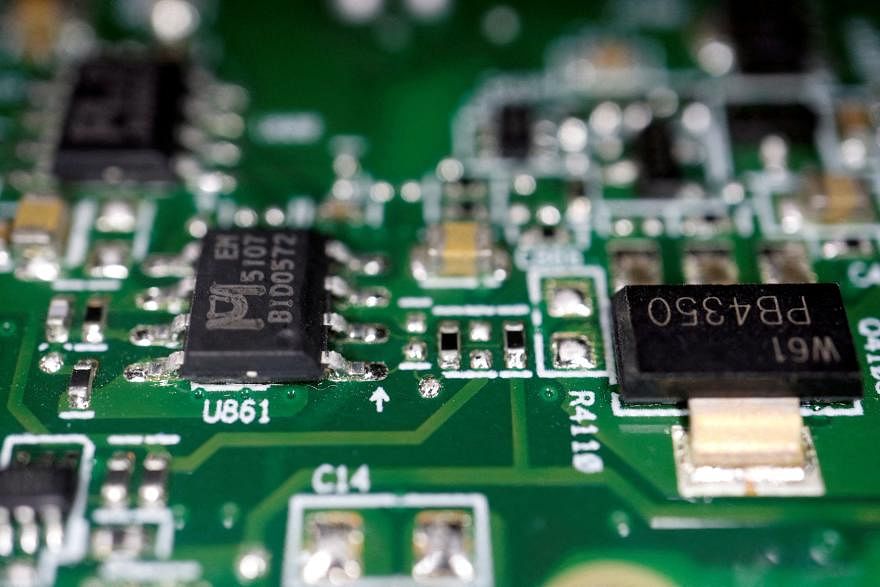

“The business environment in FY2023 was challenging for companies operating in the technology sector. This was due primarily to the steep cyclical downturn in the semiconductor industry, inflationary cost pressures, higher interest rate environment and prevailing global geopolitical uncertainties,” noted the group.

It added that it also suffered near-term impacts due to its investments in the prior two years to expand and upgrade its global manufacturing facilities.

However, both revenue and net profit in H2 2023 showed improvements from the first half of the year, during which the net profit fell 53.8 per cent year-on-year to S$12.1 million.

The recovery was buoyed mainly by continued demand and new programmes from Frencken’s key customers in the semiconductor, and analytical and life sciences segments in Europe, said the group.

The group anticipates more revenue to be generated from its semiconductor and medical segment in the coming year, while revenue from the industrial automation segment – which registered a 52.1 per cent year-on-year decrease from H2 2022 to H2 2023 – is expected to decline further.

Earnings per share for the second half stood at 4.78 Singapore cents, down from the 6.02 Singapore cents in H2 2022.

The board of directors has recommended a first and final dividend of 2.28 Singapore cents per share for FY2023, compared to the 3.64 cents per share for FY2022. The proposed dividend, if approved, will be paid on May 15.

Frencken’s shares closed on Tuesday at S$1.53, up S$0.03 or 2 per cent, before the announcement.