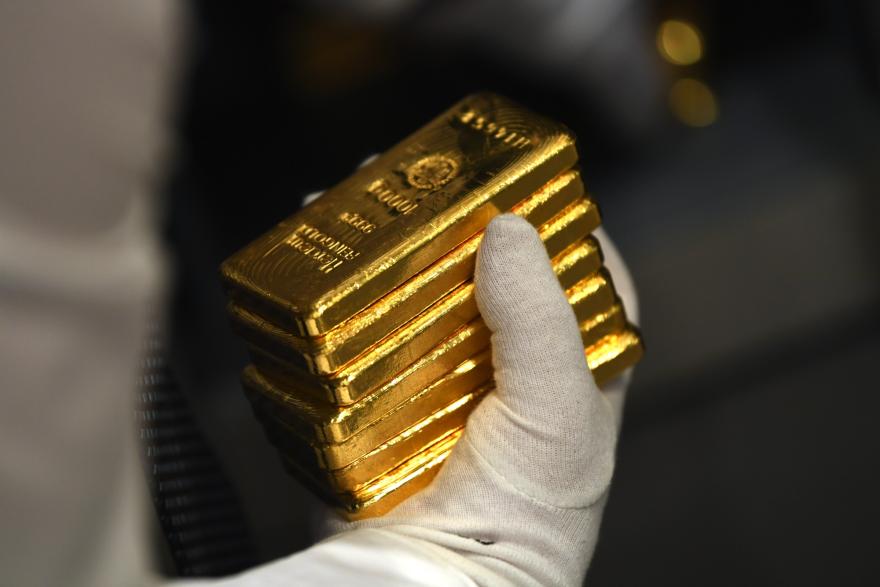

GOLD prices inched higher on Tuesday (Mar 26), buoyed by a weaker US dollar as investor focus turns to US inflation data due later this week, which could shed more light on the timing of the Federal Reserve’s first interest rate cut this year.

Spot gold was up 0.1 per cent at US$2,172.82 per ounce, as at 0122 GMT.

US gold futures edged 0.1 per cent lower to US$2,173.70 per ounce.

The US dollar index slipped 0.3 per cent against its rivals, making gold less expensive for other currency holders.

Gold prices hit a record high last week after Fed policymakers indicated they still expected to reduce interest by three-quarters of a percentage point by 2024 end, despite recent high inflation readings.

Chicago Fed Bank president Austan Goolsbee said on Monday that at the Fed’s policy meeting last week, he pencilled in three rate cuts for this year.

Meanwhile, Fed governor Lisa Cook cautioned the US central bank needs to proceed carefully as it decides when to begin cutting interest rates.

Investors now look forward to US core personal consumption expenditure (PCE) price index data due on Friday. PCE price index is seen rising 0.3 per cent in February, which would keep the annual pace at 2.8 per cent.

Traders are pricing in a 70 per cent probability that the Fed will begin cutting rates in June, according to the CME Group’s FedWatch Tool. Lower interest rates reduces the opportunity cost of holding bullion.

Spot gold may retest resistance at US$2,183 per ounce, a break above which could lead to a gain into US$2,188 to US$2,196 range, according to Reuters’ technical analyst Wang Tao.

Spot silver was flat at US$24.68 per ounce, platinum rose 0.4 per cent to US$906.10 and palladium gained 0.4 per cent to US$1,009.14. REUTERS