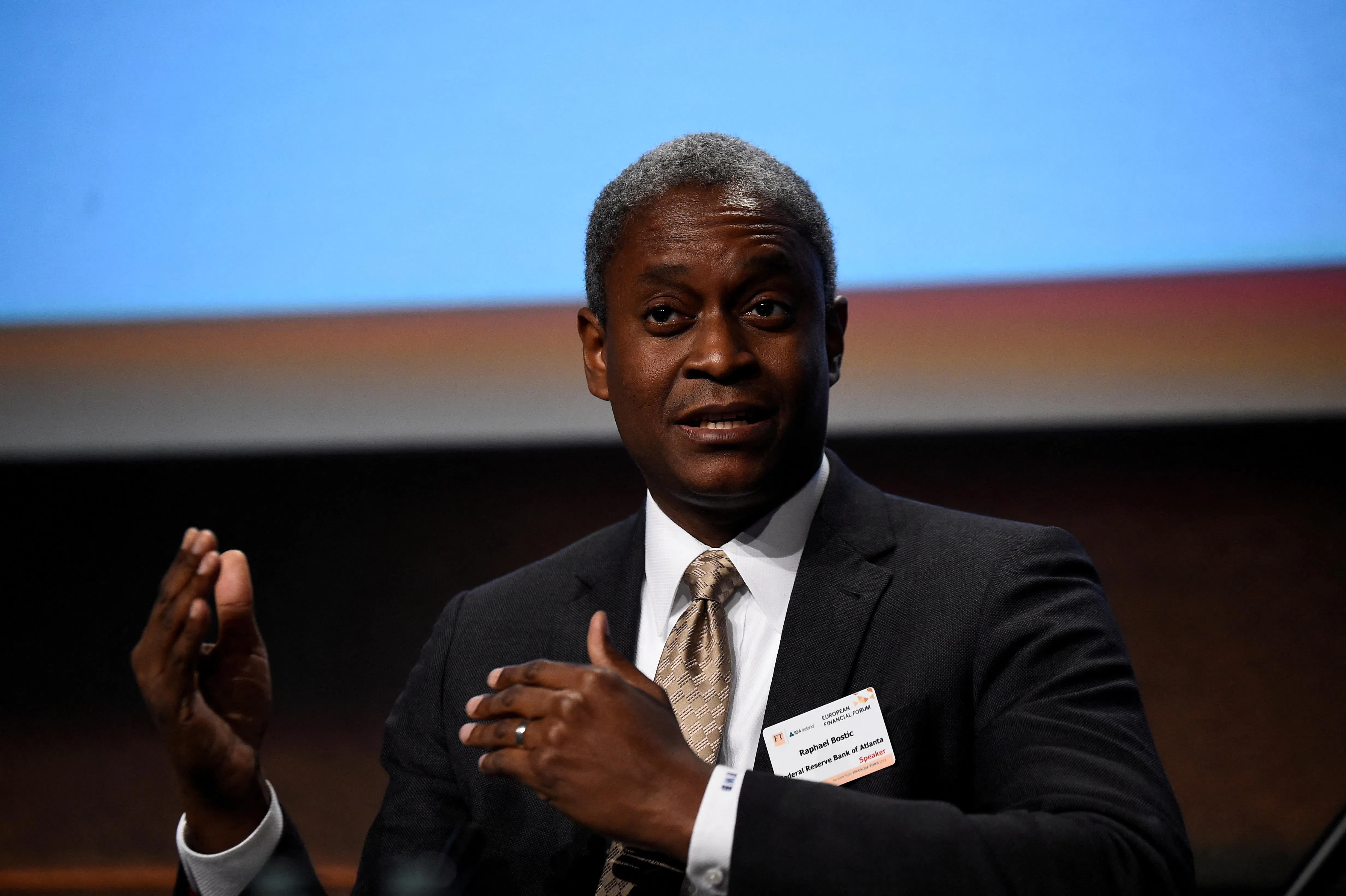

Federal Reserve’s Bostic reiterates rate cut is not likely until end of year

FEDERAL Reserve Bank of Atlanta President Raphael Bostic said he’s comfortable keeping interest rates steady, reiterating he doesn’t think it will be appropriate to lower borrowing costs until toward the end of the year.

Bostic said he still believes inflation is on the path to the central bank’s 2 per cent goal, but he noted that path is likely to be slower than people expect. The Atlanta Fed chief has previously said he anticipates just one rate reduction this year.

“Inflation is high — it’s too high — and we need to get it to our 2 per cent target,” Bostic said Thursday in Fort Lauderdale, Florida. “I’m comfortable being patient.”

Bostic, who votes on monetary policy this year, said he will continue to monitor job growth and inflation-adjusted wage gains.

“Right now, where our stance is — I think is a restrictive stance — it will slow the economy down and eventually get us to 2 per cent,” he said. “But I’m not in a mad-dash hurry to get there if all these other good things are happening.”

At a later event in Coral Gables, Florida, Bostic said that if “inflation starts moving in the opposite direction away from our target, I don’t think we’ll have any other option but to respond to that.”

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“I’d have to be open to increasing rates,” he added.

Policymakers are poised to keep interest rates at the current level, a two-decade high, after inflation has proved to be stubborn in the first three months of the year.

On Tuesday, Fed Chair Jerome Powell said persistent inflation means it will likely take longer than previously thought to gain enough confidence to lower borrowing costs.

Traders now see just one to two rate cuts this year. That’s a far cry from the roughly six they expected at the start of 2024, and the three that Fed officials penciled in just a month ago.

During the Fort Lauderdale event, the Atlanta Fed chief said American businesses and consumers are in “much better” shape than is typical in this kind of economic cycle, adding, “I am hopeful that continues.” BLOOMBERG