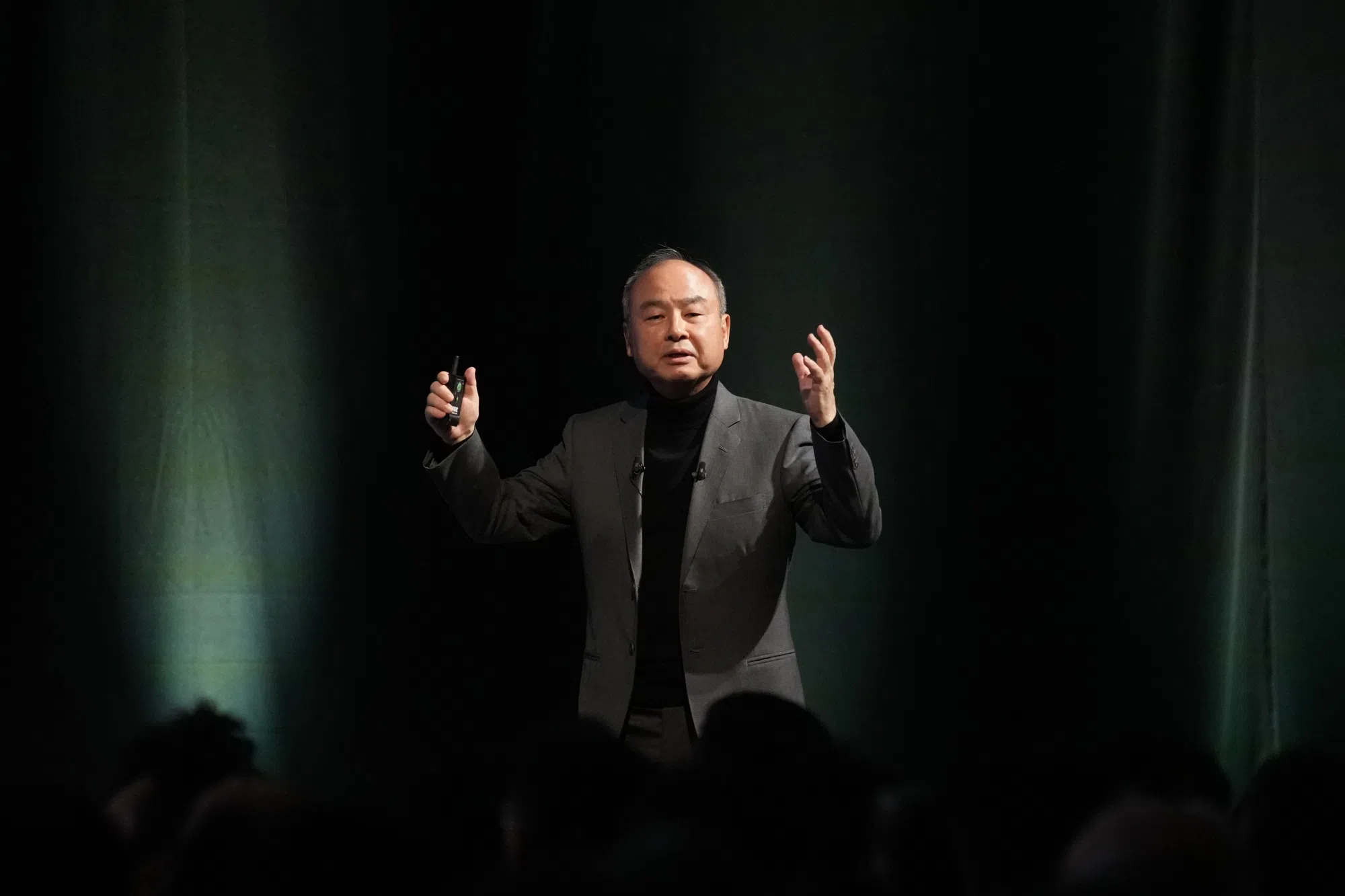

SoftBank’s Masayoshi Son is ready for next big bet after hiatus

SOFTBANK Group founder Masayoshi Son declared he’s ready to swing for the fences when he makes his next big tech bet, suggesting the Japanese conglomerate is on the cusp of making a major investment in artificial intelligence (AI).

The billionaire warned his next big endeavour could be a big hit or a bad flop – but that SoftBank had no choice but to try. That echoed SoftBank chief financial officer Yoshimitsu Goto’s recent comments about the investment firm needing to take more risk, particularly as AI development accelerates.

“We need to look for our next big move, without fear of whether it will be a hit or miss,” Son told SoftBank shareholders gathered for the wireless operator’s annual meeting. He added that the company lost billions of US dollars through its bet on WeWork. “SoftBank Group’s dynamism arises from looking for new seeds of evolution, especially abroad.”

Following a string of losses on startup bets, a humbled Son has largely shied away from the spotlight to focus on chip unit Arm Holdings and on investment strategy around AI. Thursday’s (Jun 20) comment is one of Son’s more declarative comments about his readiness to get back in the saddle again.

SoftBank will also ramp up its renewable power generation business to help supply generative AI’s power needs, especially in the US, Son also said.

Son aims to go on the offensive again after years of missteps at the Vision Fund, the sovereign wealth fund-backed investment group he set up to bet on startups. The fund is steadily selling off and writing down assets in its portfolio as Son turns his focus to AI and semiconductors.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

This year, it reported a second quarter of profit and a surge in the value of assets including Arm. SoftBank has accumulated a cash pile of 6.2 trillion yen (S$53 billion) at the end of March.

Son is seeking as much as US$100 billion to bankroll a chip venture to compete with Nvidia and supply semiconductors essential for AI, Bloomberg News reported in February.

The Japanese firm is also in talks to acquire British semiconductor startup Graphcore, Bloomberg reported. BLOOMBERG