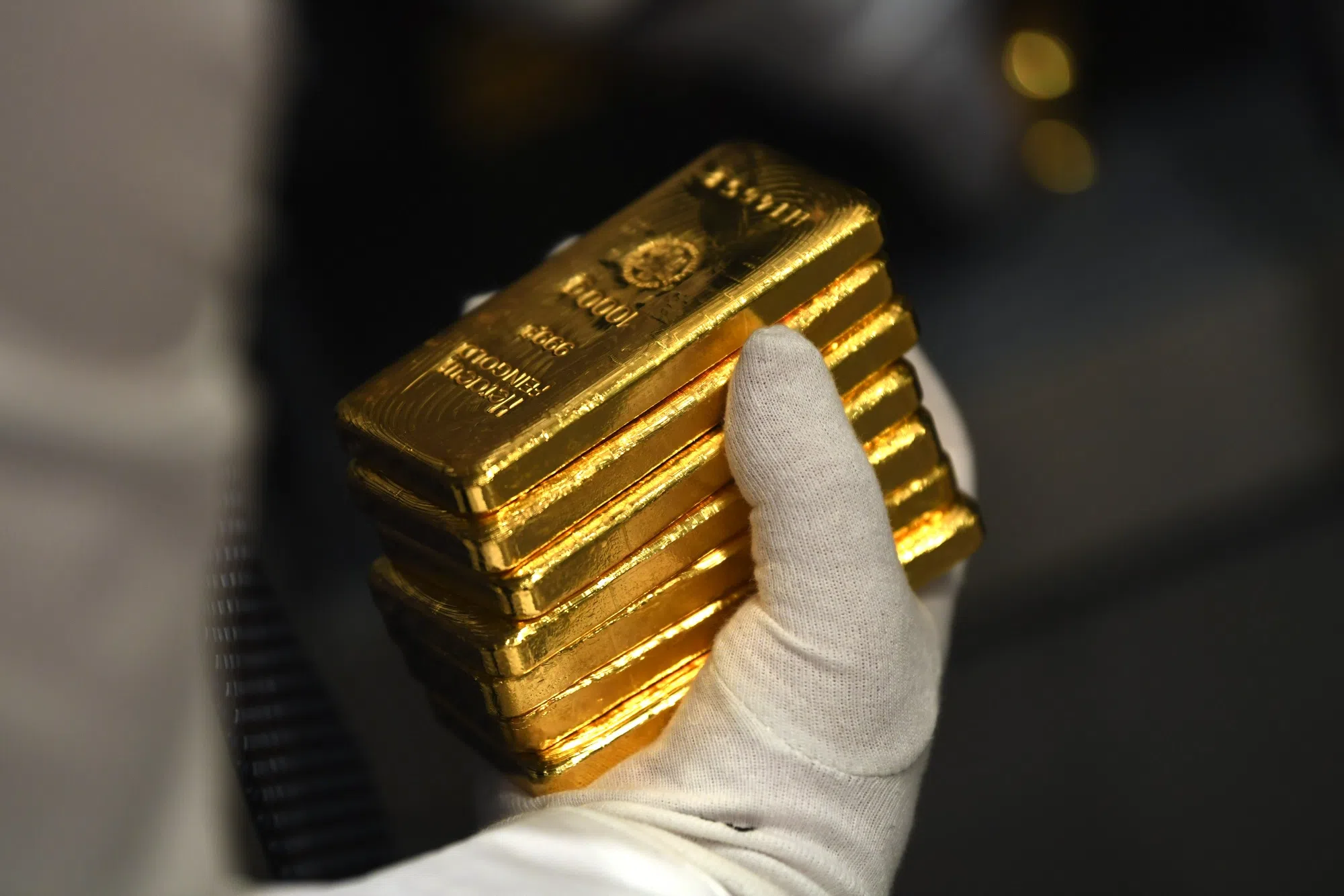

GOLD prices held steady on Monday (Jul 1) after data showed US inflation subsided, bolstering hopes that the US Federal Reserve will start cutting interest rates this year.

Spot gold rose 0.1 per cent at US$2,327.12 per ounce, as at 0202 GMT. Prices jumped more than 4 per cent in the second quarter.

US gold futures eased 0.1 per cent at US$2,336.60.

Data showed on Friday that the personal consumption expenditures index, increased 2.6 per cent after advancing 2.7 per cent in April. May inflation readings were in line with economists’ expectations.

“The latest US inflation data remain fresh on investors’ mind, with the data coming in line with consensus and generally did little to sway current market rate expectations for the Fed’s easing process to kickstart in September,” said IG market strategist Yeap Jun Rong.

But, “any failure to defend the US$2,280 level ahead may potentially pave the way for gold prices to head towards the US$2,200 next”.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Traders are pricing in a 63 per cent chance of a first rate cut in September, according to the CME FedWatch tool. Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Market focus shifts to remarks from Fed chair Jerome Powell on Tuesday, followed by minutes from the Fed’s latest policy meeting on Wednesday and US labour market data later in the week.

“Uncertainties related to inflation, macroeconomic growth, US election and geopolitics should continue to support the safe haven demand for gold,” ANZ said in a quarterly note.

“Although central bank purchases have slowed down in recent months, we believe emerging market’s central banks will continue to diversify their reserves into gold.”

Spot silver was flat at US$29.12 per ounce, platinum fell 0.2 per cent at US$990.90 and palladium inched up 1.1 per cent to US$982.62.

Key metals consumer China’s manufacturing activity fell for a second month in June while services activity slowed, an official survey showed. REUTERS