Asia: Markets rise ahead of Fed chief’s Congress testimony

ASIAN markets rose on Tuesday following gains in US stocks and ahead of Fed chief Jerome Powell’s testimony to Congress which will be closely watched for any hints on the timing of rate cuts.

The US central bank has held interest rates at the highest levels in more than two decades to bring inflation down to its long-term two per cent target without doing too much damage to either the labour market or the broader economy.

After years of focusing primarily on inflation, Federal Reserve officials have now turned their attention increasingly to the labour market, which has shown some signs of weakness in recent months despite remaining strong overall.

Traders will be keenly watching Powell’s remarks to Congress on Tuesday and Wednesday for any indications of when the Fed will start cutting rates.

The Fed chair last week fanned hopes of a cut, saying the battle against inflation had made “progress” and the job market was cooling.

“We expect Powell to reiterate the need to see more evidence of slowing inflation before cutting interest rates. But with the recent signs of softer growth and labour market, markets will closely watch if Powell gives any hints on the timing of rate cuts,” said Carol Kong at Commonwealth Bank of Australia.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“The Fed Funds futures market has currently attached almost an 80 per cent chance of the first rate cut in September,” she said.

Investors are also looking to US consumer inflation data due on Thursday for further indications that price increases are still easing as hoped, which would give the Fed greater confidence to start cutting rates.

“Powell is expected to hint at possible rate cuts starting in September if inflation continues to decline. A softer core CPI print would likely support this outlook, keeping the US dollar on a weaker trajectory,” said Luca Santos, market analyst at ACY Securities.

Wall Street’s main indices mostly advanced on Monday, with the S&P 500 and Nasdaq both reaching new records.

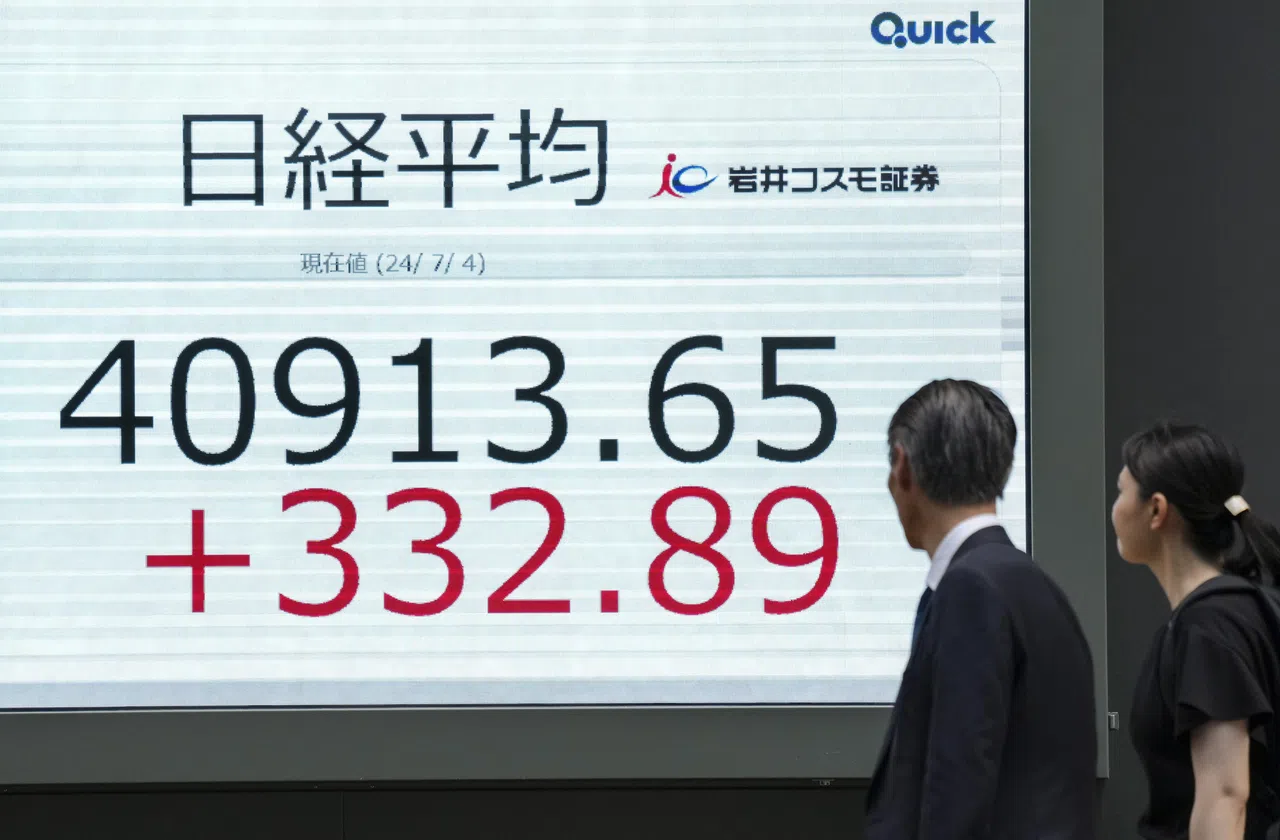

The optimistic mood continued into Asia, with Tokyo up more than one per cent while Sydney, Seoul, Singapore, Taipei, Bangkok, Kuala Lumpur and Jakarta were all higher.

Hong Kong and Shanghai were lower ahead of a key policy meeting in China next week.

US Treasury bond yields, which are closely watched as a proxy for interest rates, were little changed.

On forex markets the euro was flat against the dollar on Tuesday following the inconclusive outcome of France’s snap elections, with the single currency trading at US$1.0827.

“Following the recent French elections, political uncertainty remains high, yet the euro has shown remarkable stability during the Asian trading session,” said Santos, with its narrow trading range “reflecting a muted market response”. AFP