Temasek-backed 65 Equity Partners invests S$100 million in advanced manufacturer Hi-P

ADVANCED manufacturing service provider Hi-P has secured a S$100 million investment from Temasek-backed 65 Equity Partners.

The capital injection was through the Local Enterprise Fund, a joint S$1 billion fund with the Singapore government to develop local companies. Hi-P and 65 Equity Partners will work on a new strategic focus and leadership succession for accelerating growth and sustainability.

“We are drawn to Hi-P’s established market position and robust track record as one of the leading advanced manufacturers in Asia, with a diverse blue-chip customer portfolio – many of whom are among the top global players in their respective industries,” said Tan Chong Lee, chief executive of 65 Equity Partners.

Hi-P provides advanced manufacturing, production, assembly, testing and packaging services for customers such as Amazon, Apple and Dyson.

As part of the funding, 65 Equity Partners will get a seat on Hi-P’s board of directors. Lim Chin Hu was appointed as 65 Equity Partners’ representative on the board. He has over 30 years of experience with stints in Hewlett Packard Singapore, Sun Microsystems and Frontline Technologies. He currently serves on the boards of Singapore Exchange, ST Engineering and Kulicke & Soffa.

Part of taking on capital from the fund is for Hi-P to work towards a potential public listing in the future. The company only delisted from the Singapore Exchange in 2021, when Yao Hsiao Tung – then Hi-P chief executive and founder – made a voluntary unconditional general offer at S$2 per share.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

In February last year, Yao – now executive chairman of Hi-P – told The Business Times that it would look to a public listing in the future, eyeing a dual listing in Hong Kong or the US.

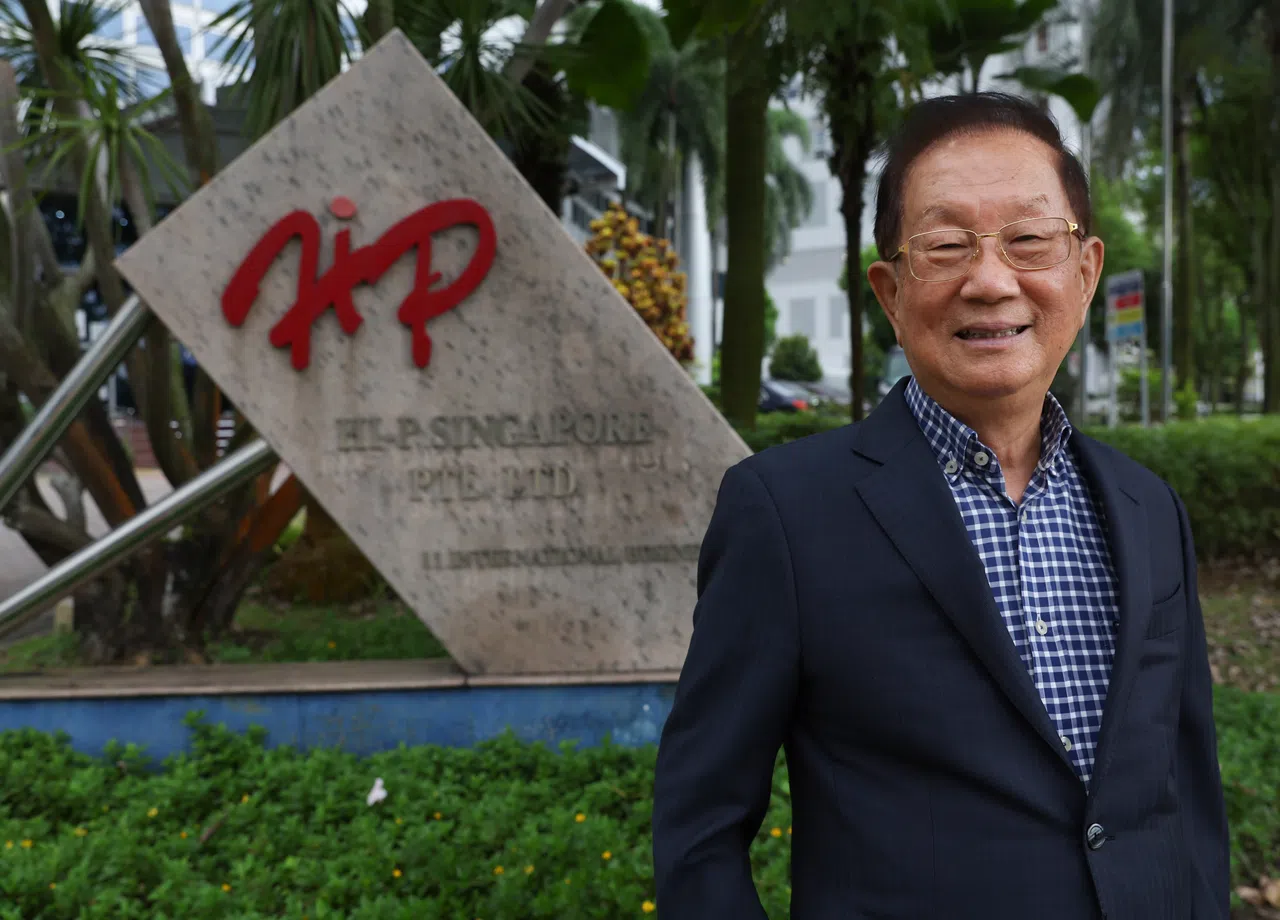

“Having grown our capabilities, capacity and customer base over the past few years, we are excited about our prospects, and look forward to working with 65 Equity Partners to hone our business strategy,” said Yao.