UMS Holdings posted a 20 per cent drop in net profit to S$9.3 million for its second quarter ended Jun 30, 2024, from S$11.6 million in the previous corresponding period.

This was mainly due to slower sales, the semiconductor company said in a regulatory filing on Monday (Aug 12).

Earnings per share stood at 1.31 Singapore cents for the quarter, down from 1.73 Singapore cents in the previous year.

Revenue for Q2 fell 25 per cent to S$56 million, from S$74.4 million a year earlier.

Sales from its semiconductor segment declined 29 per cent in Q2 from a year earlier amid weaker chip demand globally. Revenue from its “others” segment dipped 7 per cent as its material and tooling distribution business was affected by the general business slowdown in the quarter.

Meanwhile, its aerospace segment improved 5 per cent amid a sustained recovery of the aerospace industry.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

An interim dividend of one Singapore cent per share was declared for the quarter, down from 1.2 Singapore cents the year before. The dividend will be paid on Oct 25, after the record date on Oct 14.

For the half-year period, net profit was down 34 per cent at S$19.1 million, while revenue fell 29 per cent to S$109.9 million.

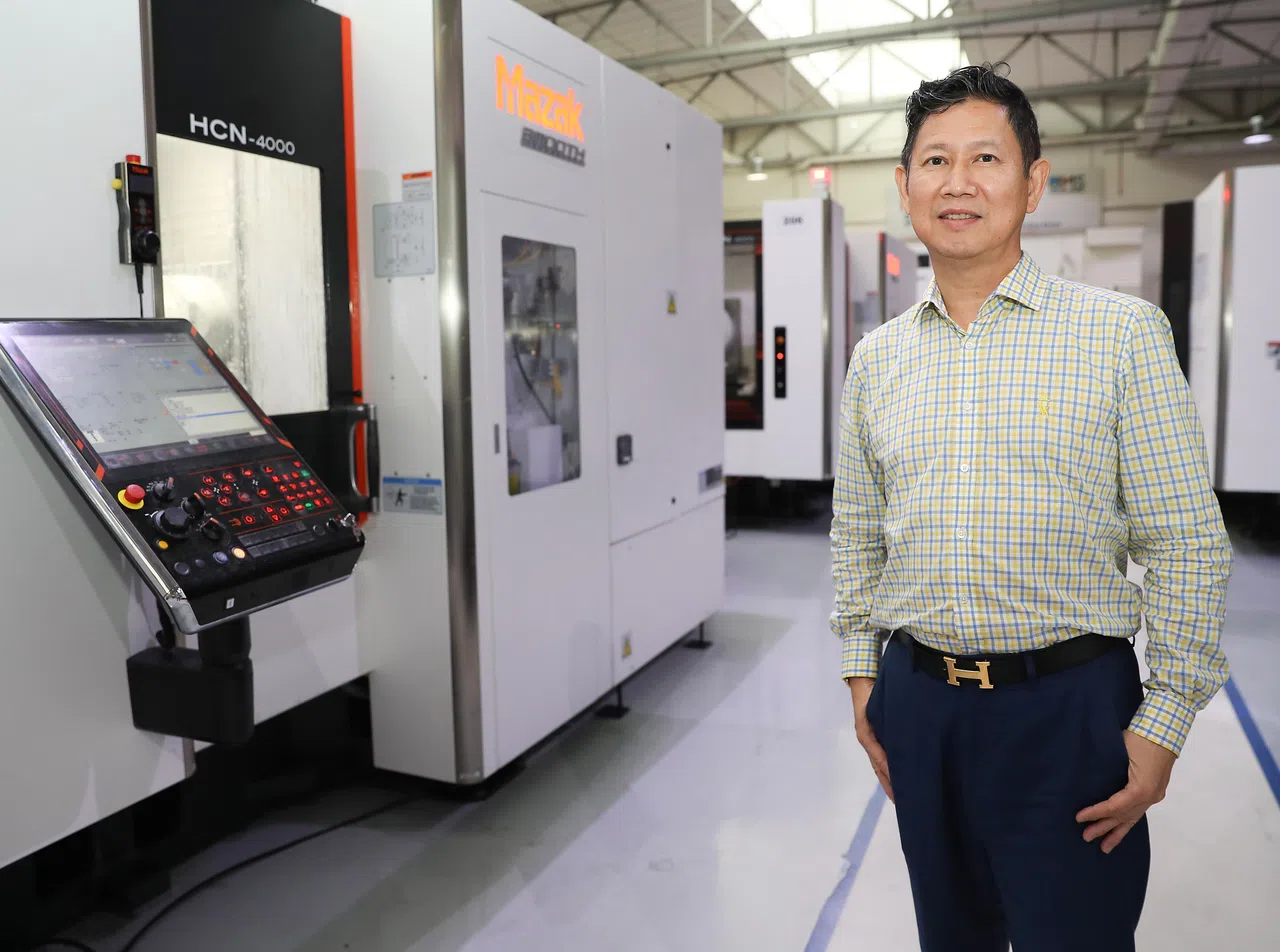

Andy Luong, UMS chairman and chief executive, noted that the company did better in the second quarter compared with the first, despite the ongoing market turbulence, political tensions and challenging global chip industry.

“Our performance in the past six months has again reinforced the group’s resilience and ability to leverage on our twin growth engines – semiconductors and aerospace – to propel us forward,” Luong said.

He expects the company to benefit from a rebound in the global chip sector and the rising shift of global semiconductor supply chains to the region.

It is also well placed to capitalise on the post-Covid aviation boom, he added.

The company expects to remain profitable in the 2024 financial year.

Shares of UMS closed 2.9 per cent or S$0.03 higher at S$1.06 on Monday, before the release of the results.