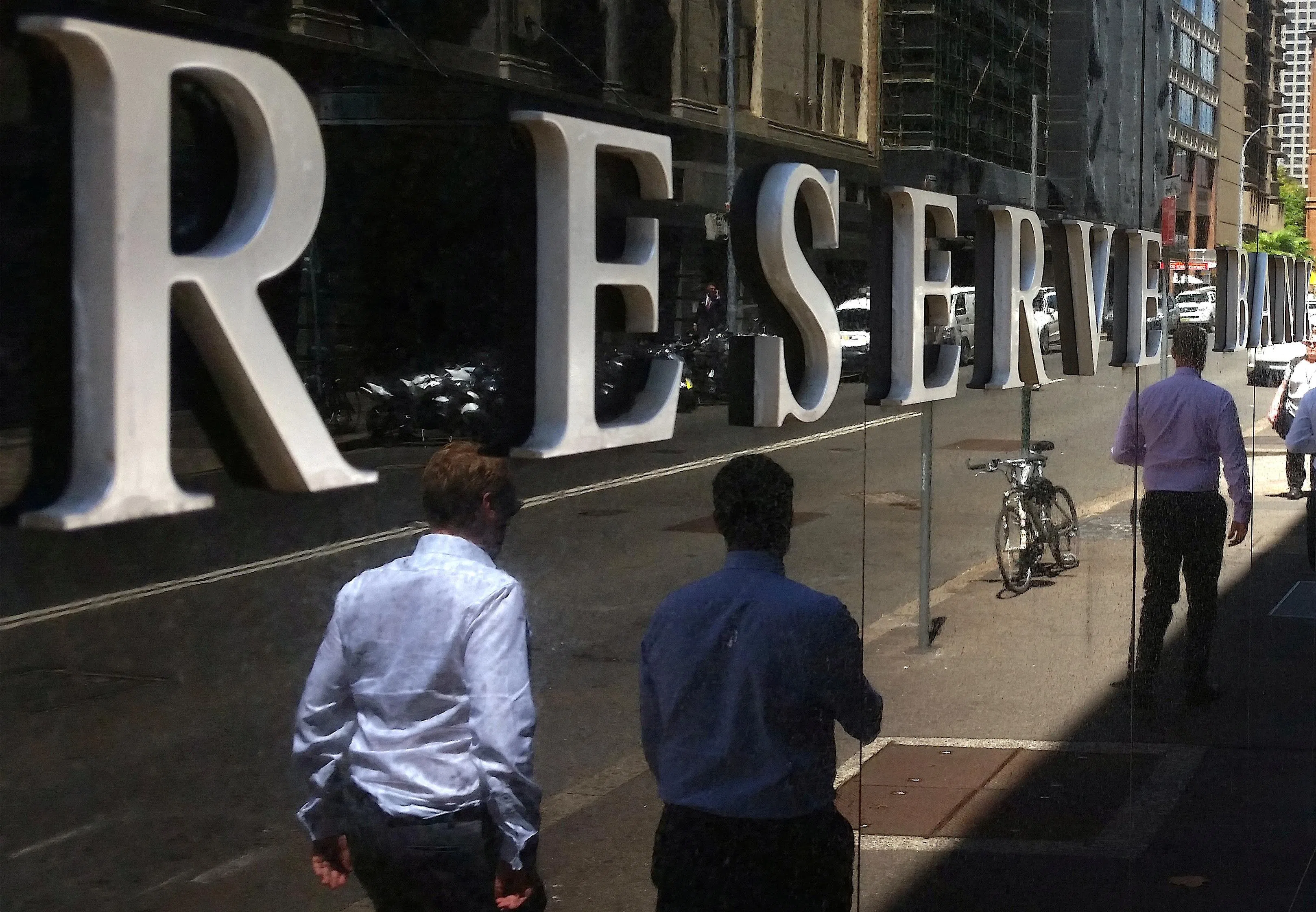

Australia central bank signals rates will stay at 12-year high for ‘extended period’

AUSTRALIA’S central bank will likely need to hold interest rates at their current 12-year high for an “extended period” to ensure that inflation returns to its target band next year, in a strong signal that policy easing remains some way off.

Minutes of the Reserve Bank of Australia’s (RBA) Aug 5 to 6 meeting released on Tuesday (Aug 20) showed the board discussed further tightening but decided that the case to leave the key rate at 4.35 per cent was the “stronger one”.

Members noted that “holding the cash target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe”, the minutes showed. “Monetary policy will need to be sufficiently restrictive until members are confident that inflation in moving sustainably towards the target range.”

The board intends to place a “somewhat greater-than-usual weight” on the flow of data, it said. The RBA also reiterated that it will do what’s necessary to return inflation to its 2 to 3 per cent target and that it was “not possible to either rule in or rule out” future policy changes.

The minutes shine a spotlight on the board’s policy conundrum at a time when Australia’s inflation remains elevated and sticky while the rest of the world is slowly embarking on an easing cycle. Neighbouring New Zealand reduced rates last week, following Canada, Sweden and the UK while the US Federal Reserve is all but certain to cut next month.

One difference is that the RBA raised rates at a slower pace than peers and its benchmark is about one percentage point less than some of them. Policymakers have repeatedly cited a desire to preserve recent labour market gains while battling inflation to justify their policy action.

“Holding the cash rate steady best balanced the risks surrounding the outlook for both inflation and the labour market” given current uncertainties, the minutes showed, as board members reinforced the need to remain “vigilant to upside risks to inflation”.

Financial market pricing implies the RBA’s next move is down, with a cut seen as soon as December. A Bloomberg News survey showed that a majority of economists expect the RBA to keep the cash rate steady this year.

The minutes showed the board devoted a fair bit of time to reviewing the case for a hike. The RBA discussed:

-

Underlying inflation was proving persistent.

-

The risk of inflation not returning to target within a reasonable timeframe had increased, reflecting the slow pace of disinflation over the preceding year and the staff’s judgment that the gap between aggregate demand and supply was larger than previously assessed.

-

The board’s strategy was “still to bring inflation back to target within a reasonable timeframe and their tolerance for this timeframe being pushed out further was limited”.

-

Persistence of cost pressures was a key theme reported by firms in liaison discussions.

-

Financial conditions appeared to have eased modestly as housing prices and credit growth had picked up and bond yields had declined. BLOOMBERG