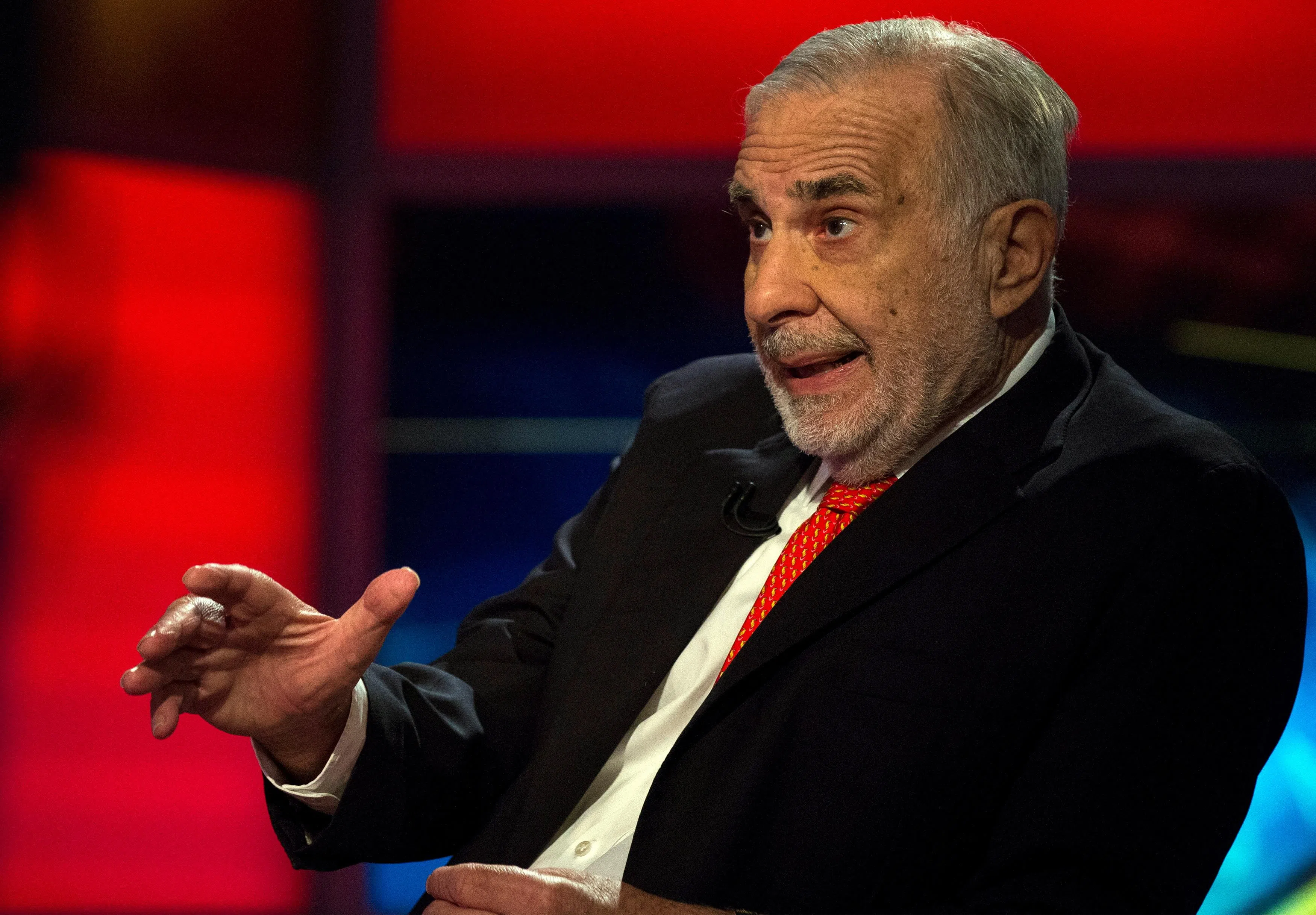

CHIEF executive officers of public companies have long feared Carl Icahn. The 88-year-old investor made a name and billions for himself by questioning the decisions and strategies of corporate leaders, and agitating for change at companies including Apple, RJR Nabisco and Netflix.

But now Icahn is under intense scrutiny from Wall Street investors, who are rapidly selling his company’s stock. In the past year and a half, shares of Icahn Enterprises, his publicly traded investment company, have dropped more than 75 per cent, losing nearly US$20 billion of value. After dropping more than 30 per cent since mid-August alone, it now trades at about US$10.53 a share, its lowest level in more than two decades.

Icahn owns roughly 86 per cent of the shares, so he has personally lost about US$17 billion.

Some Wall Street investors are now worried that the stock’s continuing fall could threaten the health of the entire company and that it could be forced to sell companies it holds. Icahn Enterprises holds a mix of public stocks, real estate and other investments, according to interviews with Bilson and several other market watchers.

Investors have been questioning whether Icahn himself has been selling his stock. He has taken out personal loans using his stock as collateral. Banks that offer these loans typically have strict requirements related to the value of a company. A sharp drop in a stock price could force a lender to sell shares.

In an interview this week, Icahn said that he was “absolutely not selling”.

Shares in Icahn’s company started tumbling in May 2023 when Hindenburg Research, the short-selling firm run by Nate Anderson, published a report questioning Icahn Enterprises’ financials. Among other things, Hindenburg accused Icahn Enterprises of having a “Ponzi-like economic structure” and paying a dividend it couldn’t afford. (It has since cut its dividend.) He also questioned Icahn’s use of personal loans backed by the stock.

Anderson said in an interview this week that he expected Icahn Enterprises’ stock would still fall further. He said Icahn’s extensive use of personal loans is still dangerous to the company’s future. “He’s got too much debt and needs cash. He’s really cornered himself,” he said. “There’s no safe exit.”

In the interview, Icahn said that Anderson’s statements on him and his firm are “what we consider to be compete and total lies and extremely misleading”. NYTIMES