Asia: Crude stable after Israel-Iran surge, Hong Kong stocks resume gains

OIL prices stabilised on Friday (Oct 4) after soaring on fears about the Middle East crisis as investors await Israel’s response to Iran’s missile attack, while shares in Hong Kong resumed their rally on a mixed day for equity markets.

Speculation about Israel’s response to the scores of missiles fired at it on Tuesday has stoked concern that the region could erupt into a wider conflict that incorporates Iran.

Crude has risen around 10 per cent since that launch owing to fears of a hit to supplies, while China’s recent drive to reignite its vast economy has the potential to cause a surge in demand.

Both main contracts rocketed around 5 per cent on Thursday when US President Joe Biden said he was “discussing” possible Israeli strikes on Iranian oil sites in retaliation for Tehran’s missile barrage on Israel.

They later settled back and were slightly higher in early Asian trade.

As Israel continues to carry out air and ground attacks in Lebanon targeting Hezbollah, Iran, which arms and funds the militant group, said it would step up its response in the event of a retaliation.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Supreme leader Ayatollah Ali Khamenei is expected to elaborate on Iran’s thinking in a sermon at the main weekly Muslim prayers in Tehran on Friday, his first in nearly five years.

Still, IG market analyst Tony Sycamore said it was unlikely Iran’s oil would be targeted owing to the fact it could rekindle inflation just as global central banks fight to bring it down.

“Instead, Israel is more likely to target critical weapons factories and military installations, similar to actions taken in April,” he wrote.

“In the aftermath, there is hope for a return to the shadow conflict that has been ongoing between Israel and Iran’s regional proxies since the Oct 7 Hamas attack.”

He added that if the crisis did escalate into a direct confrontation, “there’s a risk that Iranian oil (four per cent of global supply) could be cut off by embargos or military actions”.

“The potential loss of Iranian supply might be offset by the return of Libyan oil and increased Saudi production, as voluntary supply cuts are set to expire on Dec 1,” he said.

On equity markets, Hong Kong was back on the front foot after retreating for the first time on Thursday since China last week unveiled a raft of economy-boosting measures that has seen investors flooding back to the market.

The stimulus – mainly targeting the property sector – has seen stocks in the city and mainland China enjoy a blistering run of more than 20 per cent on hopes that Beijing can finally reignite growth.

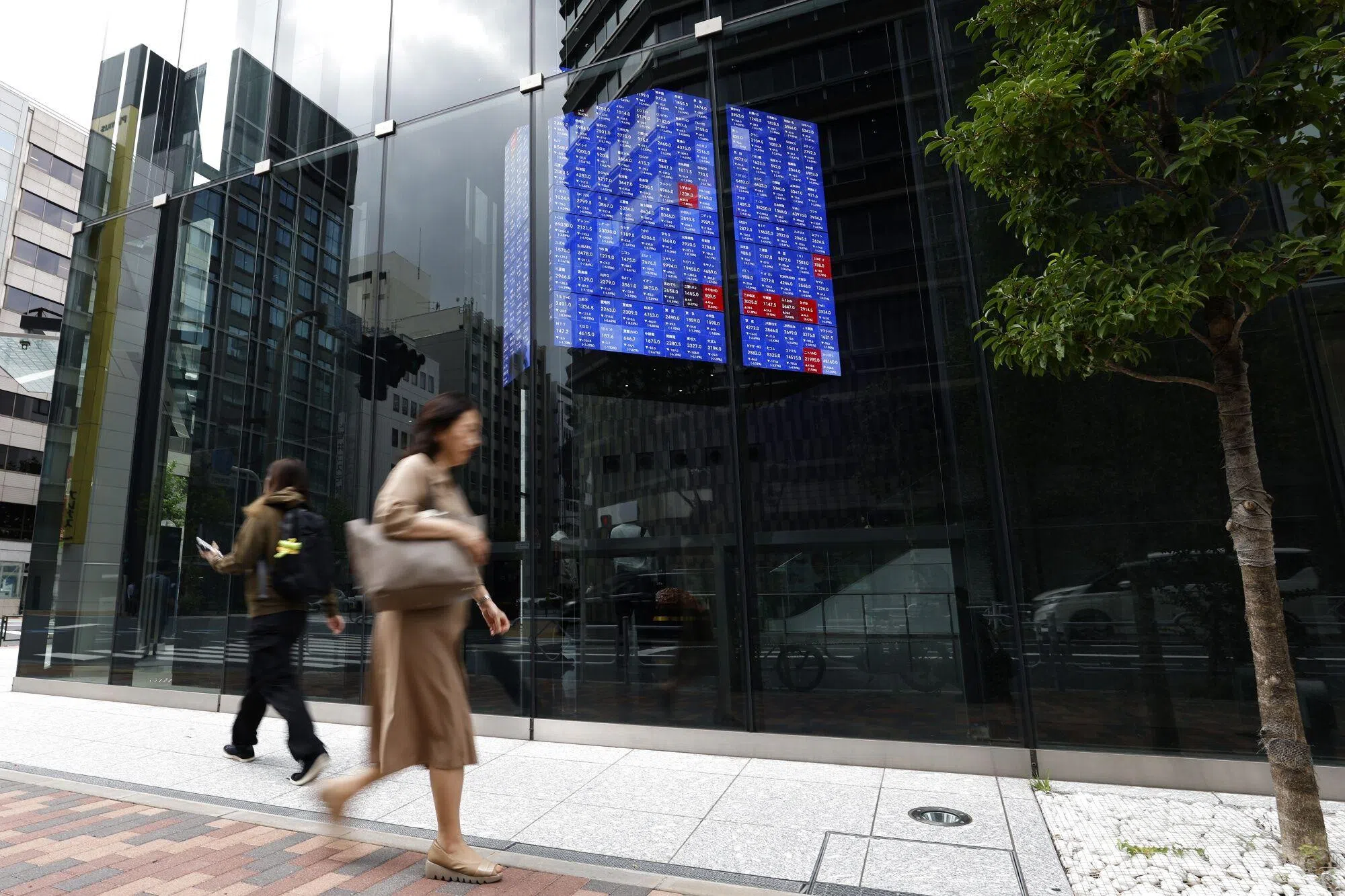

There were also gains in Tokyo at the end of a rollercoaster week dictated by a volatile yen after the election of Shigeru Ishiba as prime minister.

The yen initially surged to less than 142 per US dollar on the news owing to Ishiba’s previous support for Bank of Japan interest rate hikes, but it sank later in the week to more than 147 after he said the country was not yet ready for a third increase this year.

It was around 146.50 on Friday.

Singapore, Seoul and Manila rose, though Sydney, Wellington, Taipei and Jakarta edged down.

Investors are now awaiting the release of key US jobs data later in the day, which they hope could provide an idea about the Federal Reserve’s thinking on whether or not to cut rates again this month, and if so by how much. AFP