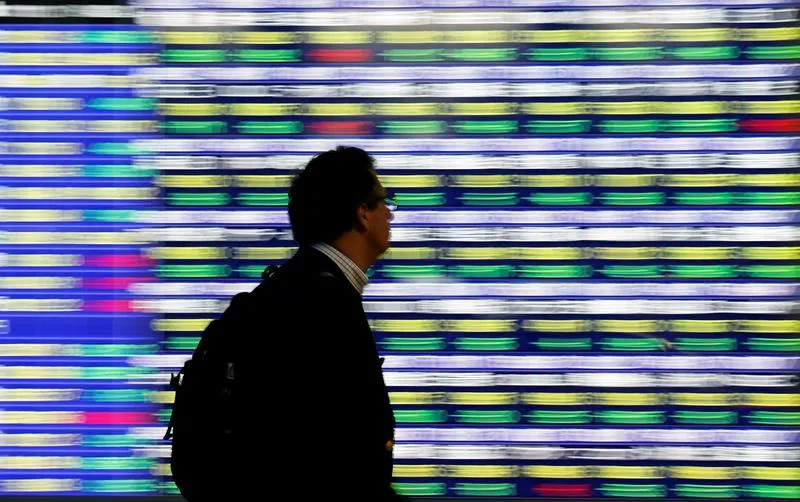

ASIAN markets fluctuated on Friday (Oct 18) after China posted its weakest economic growth in a year and a half, as gold prices hit a record high and following a tepid lead from Wall Street.

Investors have been clamouring for Beijing to deliver more concrete plans for the country’s stuttering economy since last month’s slew of stimulus announcements that had fanned hopes officials would unload the “bazooka” policy many have been calling for.

However, after a blockbuster rally across the mainland and Hong Kong markets, three high-level briefings that had caused much anticipation fell well short of expectations and sparked a sell-off that ate into those early gains.

Friday’s news that gross domestic product expanded by 4.6 per cent drove home the need for more help.

While it was fractionally better than what was forecast in an AFP survey of economists, the figure marked the slowest pace of growth since the start of 2023 – the quarter after the lifting of strict Covid-19 pandemic measures.

Authorities have struggled to reignite the world’s number two economy as it battles a stinging debt crisis in the property sector and torpid consumer activity.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The measures announced so far address some of the issues but observers have called for more action, with many warning the government would struggle to hit its five per cent annual target this year.

Still, news that retail sales – a gauge of consumer spending – and industrial output rose more than expected in September was a bright spot.

Shares in Hong Kong and Shanghai edged up in the morning as investors digested the latest reports, while there were also gains in Tokyo thanks to a weaker yen.

Wellington, Taipei, Manila and Jakarta also rose, but Sydney, Singapore and Seoul edged down.

Gold rose past US$2,700 to a new record and crude prices edged up on geopolitical uncertainties after Israel said it killed Hamas chief Yahya Sinwar.

Traders were already on edge over the crisis in the Middle East as Israel battles Hamas in Gaza and, more recently, Hezbollah in southern Lebanon, with worries about a region-wide war that could take in Iran.

Wall Street had a largely uneventful day as forecast-topping US retail sales saw investors scale back bets on Federal Reserve interest rate cuts and pushed the US dollar higher against the yen and euro.

Adding to downward pressure on the single currency was another rate cut by the European Central Bank and an indication that more could be in the pipeline as inflation comes down. AFP