TPG proposes to privatise Econ Healthcare in S$88 million deal

US private equity firm TPG, through its special purpose vehicle, is looking to take Catalist-listed nursing operator Econ Healthcare (Asia) private by way of a scheme of arrangement, in a near S$88 million deal.

Incorporated in the Cayman Islands, the offeror Enabler Bidco is looking to acquire all of the issued shares of Econ Healthcare, the company said on Friday (Feb 14).

As at Friday, Econ Healthcare has an issued and paid-up share capital comprising 265.9 million shares.

Each shareholder will be entitled to receive, at their election, either S$0.33 per share in cash, or S$0.224 per share in cash and about 0.32 Enabler Holdco shares.

The sole shareholder of Enabler Bidco is Enabler Midco, whose sole shareholder is Enabler Holdco. Enabler Holdco’s shareholder is One Aged Care Holdco, which is indirectly wholly owned by TPG Fund.

The offer price represents a 20 per cent premium to the counter’s last traded price on Jan 14 of S$0.275. The company on the same day informed shareholders it was in preliminary discussions regarding a possible transaction.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The offer price also represents a premium over the volume-weighted average price per share up till Jan 14 – of 33.6 per cent for one month; 42.9 per cent for three months; 48.6 per cent for six months and 52.1 per cent for 12 months.

Enabler Bidco believes that privatising Econ Healthcare will provide “the necessary flexibility to focus on long-term execution”, while helping the company save costs and resources associated with maintaining its listed status.

Both parties said that realising plans to compete effectively with other players and to expand the business would require “significant amount of capital for capital expenditures, potential strategic investments and opportunistic acquisitions into Singapore and Malaysia’s aged care and comprehensive healthcare sectors”.

They noted that if Econ Healthcare remains listed, raising capital through rights issues or private placements could take time and be dependent on market conditions and investor appetite.

“Such capital raise efforts could also incur higher costs and dilute shareholders’ interests in the company,” they added.

Additionally, the offer presents shareholders with an opportunity to realise their investment at a premium over historical market prices without incurring brokerage and trading costs.

Enabler Bidco intends to retain the current management team, with Ong Hui Ming – the current Singapore chief executive of Econ Healthcare – replacing current executive chairman and group CEO Ong Chu Poh as the new group CEO.

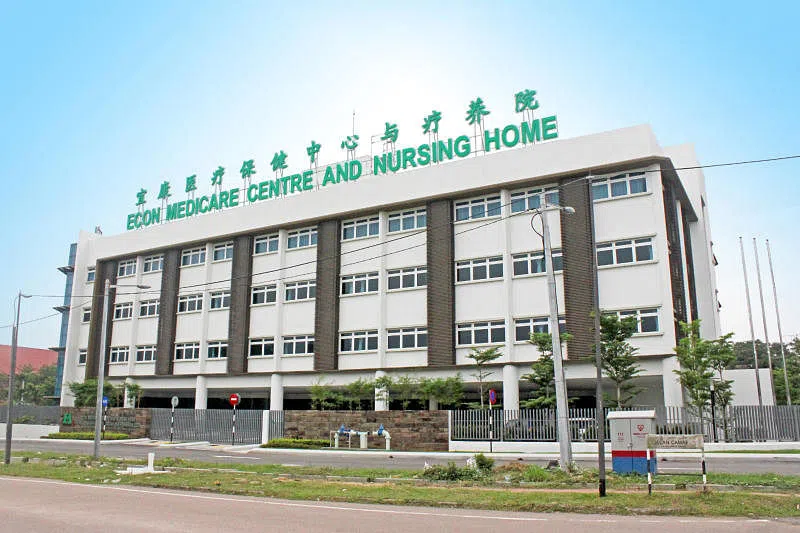

Econ Healthcare was incorporated in 2004 and has been listed on the Catalist board since April 2021. The group operates 10 medicare centres and nursing homes in Singapore and Malaysia, and also has a presence in China.

The counter traded flat at S$0.34 as at 9.32 am on Tuesday.