HONG Kong is considering approving derivatives and margin lending in virtual assets for some investors, its financial regulator said on Wednesday (Feb 19), as the city seeks to boost its competitiveness as a digital assets hub and attract capital.

Hong Kong first drew up a plan to become a virtual asset trading centre in 2022 – an effort that followed Beijing’s sweeping ban on all cryptocurrency transactions in mainland China the previous year.

It has since launched the first spot crypto exchange-traded funds in Asia and other initiatives.

“We are considering derivative products for professional investors, margin lending for certain customers,” Securities and Futures Commission (SFC) CEO Julia Leung told CoinDesk’s Consensus Hong Kong 2025 conference, referring to digital assets.

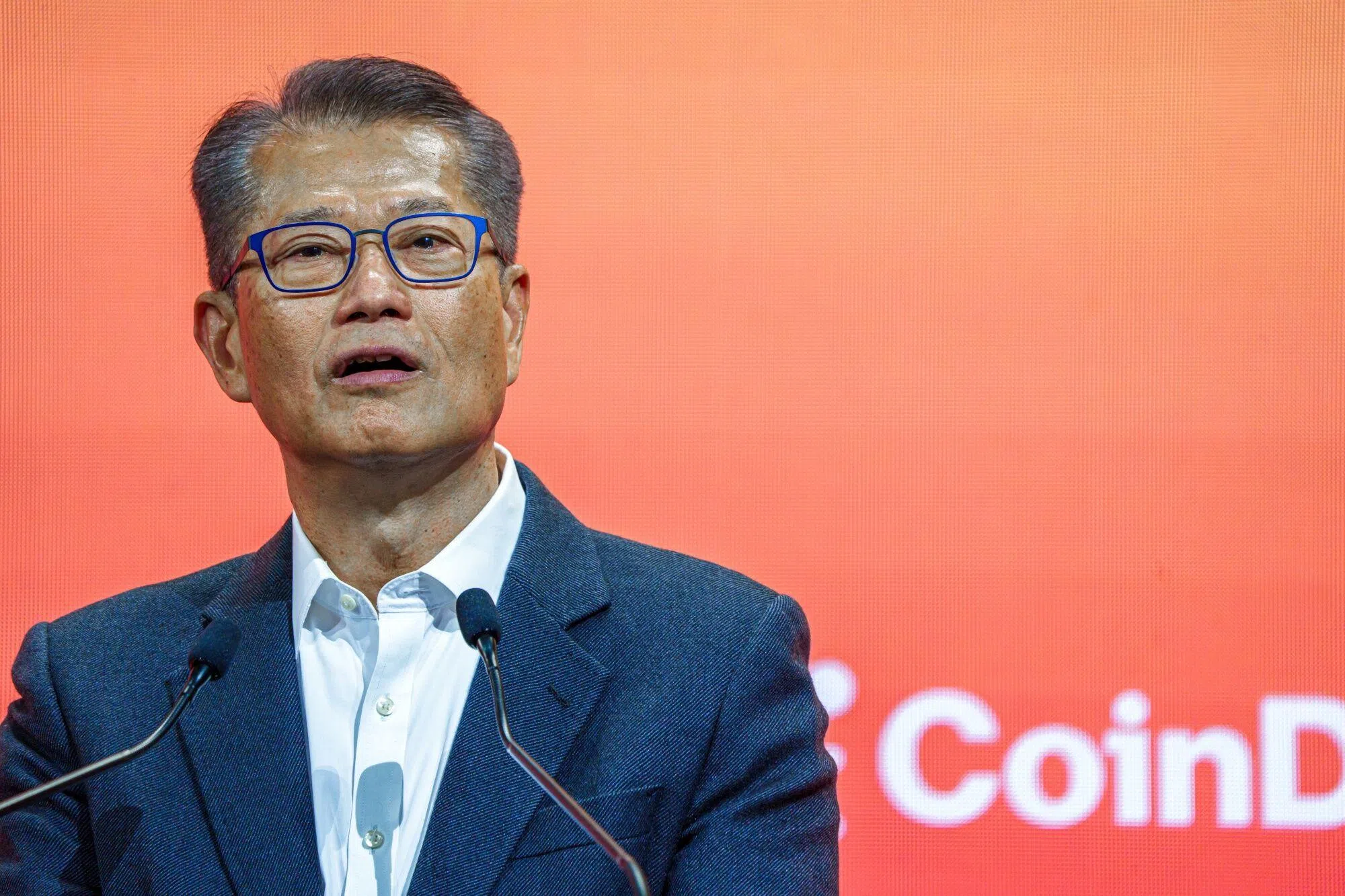

The city’s financial secretary, Paul Chan, told the event the city’s regulators have so far issued nine virtual asset trading platform (VATP) licences.

Bullish Group, a cryptocurrency exchange which owns crypto news website CoinDesk, said it had been granted one of the licences on Tuesday.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Leung said there are eight more applications being considered, and Chan said the government was also working to advance the regulation of stablecoin cryptocurrencies.

Hong Kong’s SFC will release a virtual asset roadmap later on Wednesday with detailed growth plans, Leung added.

Alongside Hong Kong, Singapore and Dubai are also aiming to become global hubs for virtual assets.

Consensus Hong Kong is the first major crypto industry gathering since US President Donald Trump took office last month, promising crypto-friendly policies, and speakers expressed a bullish view on the regulatory environment.

“There’s a big shift in sentiment in the US,” said Richard Teng, chief executive of Binance Holdings.

He said some sovereign wealth funds and institutional investors have gone from debating whether they should invest in crypto to considering how much they should invest.

Separately, Justin Sun, founder of the Tron blockchain network, told a panel he had invested in World Liberty Financial – a newly launched crypto company partly owned by Trump – because it focuses “on bridging traditional finance with the crypto world”.

The price of Bitcoin more than doubled last year. It hit an all-time high of US$109,071 on Jan 20 this year, the day of Trump’s inauguration, but has since pulled back to stand at about US$96,000. REUTERS