1963: City Developments Ltd (CDL) begins operations with eight staff in a small, rented office at Amber Mansions and was listed on the Malayan Stock Exchange in November 1963.

1966: Company completes its first Singapore condominium project Clementi Park.

1969: Kwek Hong Png’s Hong Leong group buys into CDL, and son Leng Beng takes a position on the board.

1972: Hong Leong Group acquires a controlling interest and starts to grow the business in property development. CDL makes its first foray into the hospitality industry with the acquisition of King’s Hotel.

1974: Hong Leong patriarch and founder Hong Png takes on chairmanship of CDL. Leng Beng appointed managing director.

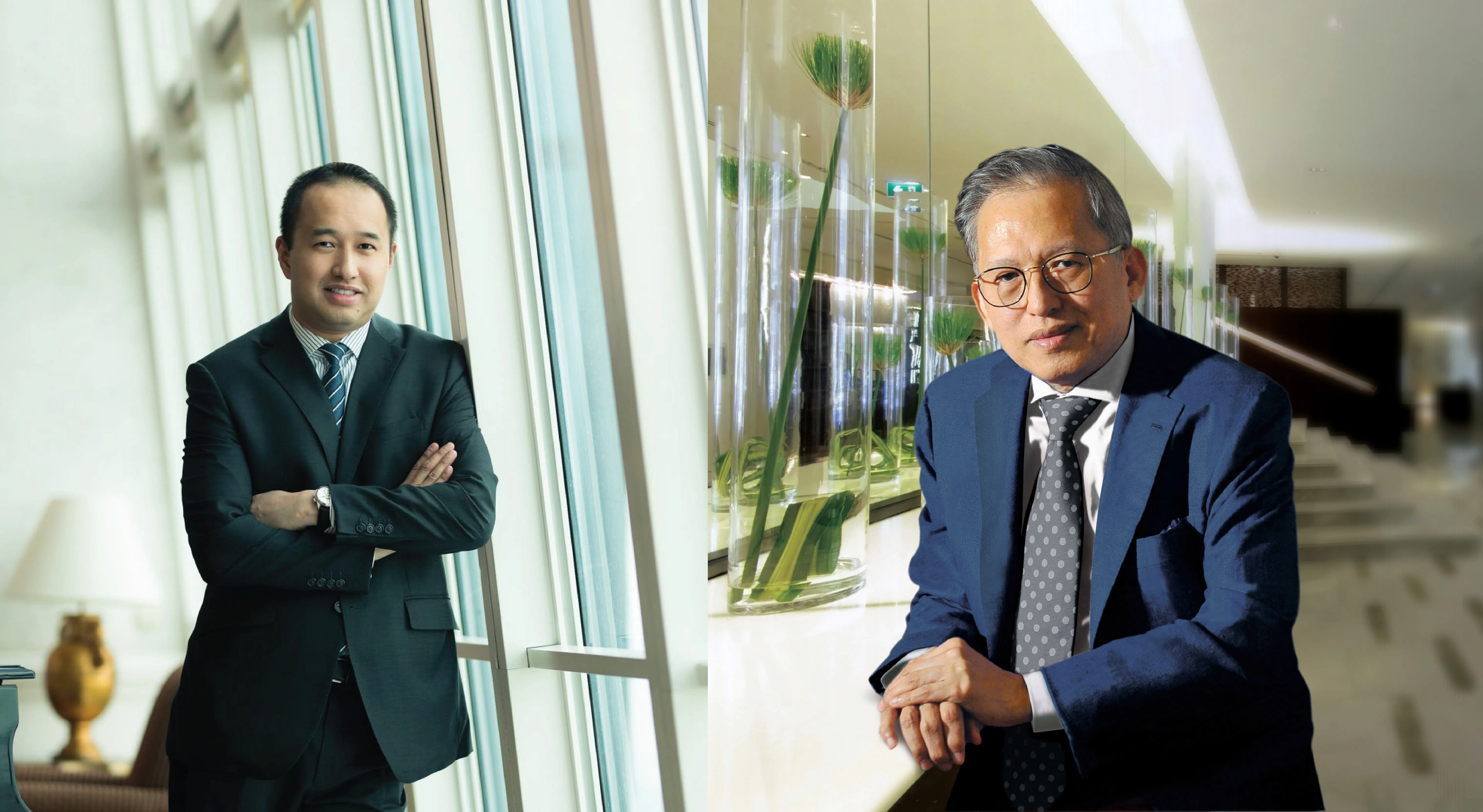

1995: CDL appoints Leng Beng executive chairman and Leng Joo managing director.

A NEWSLETTER FOR YOU

Tuesday, 12 pm

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

CDL Hotels, Saudi Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud buy 80% of New York’s iconic Plaza Hotel from Donald Trump for US$325 million.

1996: Millennium & Copthorne Hotels (M&C), a subsidiary of CDL Hotels International, lists on London Stock Exchange.

2013: The Plaza sold to a consortium for US$675 million (USD) in 2013.

2016: Sherman Kwek named deputy CEO. Yiong Yim Ming appointed CFO. Kwek Leng Beng’s nephew Kwek Eik Sheng appointed head of asset management on top of his role as CDL’s chief strategy officer.

2017: Leng Beng retires from Hong Leong Asia. His cousin Kwek Leng Peck, then an executive director, succeeds him as executive chairman of HLA.

2018: Sherman Kwek takes on the role of CEO. He was earlier appointed as CEO-designate after CEO Grant Kelley tendered his resignation.

2019: M&C, which owns, manages and operates over 145 hotels globally, delists from London in October following a successful privatisation.

2020: CDL struggles with its China expansion during the pandemic as a result of a deal with Chinese developer Sincere Property Group. The joint-venture deal, spearheaded by Kwek’s son Sherman in 2019, said to have caused a rift within the family. In FY2020, the group wrote off S$1.78 billion on the investment and posted a net loss of S$1.9 billion for the year.

Non-executive and non-independent director Kwek Leng Peck left the property giant in October, citing his disagreements with the board and management on the group’s investment in Sincere property group and its management of M&C.

2021: The company sells its stake in Sincere Property Group for US$1. The group posts an S$85 million (restated) net profit for FY2021.

2022: The group posts a record profit of S$1.3 billion in FY2022.

2023: CDL posts a 94.1 per cent drop in net profit to S$66.5 million for its first half ended Jun 30, 2023, from S$1.1 billion previously. This was mainly due to the absence of significant divestment gains booked in H1 2022, as well as greater financing costs and impairment losses on its UK investment properties in the latest period.

After the Sincere saga, Kwek Leng Beng meets Shanghai mayor Gong Zheng in China, to discuss business issues and potential collaboration on sustainability projects.

2024: CDL acquires Hilton Paris Opera Hotel from Blackstone for 240 million euros (S$350.2 million).

The company celebrates its 60th anniversary, and posts a 32 per cent year-on-year rise in first-half net profit to S$87.8 million.

Jan 2025: CDL announces it had divested more than S$600 million in 2024 as part of its capital recycling initiative, including holdings in a Suzhou project.

Feb 2025: CDL posts a profit of S$113.5 million for its second half ended Dec 31, down 54.7 per cent from S$250.8 million previously. The company abruptly calls off its FY 2024 results briefing in the morning and halts trading. News of the boardroom battle emerges with Kwek Leng Beng’s statement.