After Hurricane Milton, many policyholders face challenges in securing the compensation they deserve. Insurance claims can be complicated, and insurers often deny or undervalue valid claims. A Hurricane Milton Insurance Lawyer can help navigate these complexities and fight for the full benefits owed under your policy.

These lawyers understand the specific obstacles caused by Hurricane Milton’s damage and know how to handle disputes with insurance companies. They work to ensure clients are not shortchanged or pressured into unfair settlements.

With experience in hurricane-related insurance claims, these attorneys guide clients through documentation, negotiations, and potential litigation. Their expertise allows them to spot errors, missing evidence, or unfair practices insurers may use to avoid responsibility.

Understanding Hurricane Milton Insurance Claims

Insurance claims after Hurricane Milton often involve complex details about damage and policy coverage. It is essential to identify what types of damage are covered, why claims may be denied, and how to properly document losses to improve the chances of approval.

Types of Hurricane Damage Covered by Insurance

Most standard homeowner’s insurance policies cover damage caused by high winds, including roof damage, broken windows, and structural issues. Flood damage is typically excluded unless separate flood insurance is purchased through the National Flood Insurance Program (NFIP) or a private insurer.

Other covered damages frequently include fallen trees, water damage from rain entering through broken surfaces, and damage to personal property inside the home caused by storm conditions. A Hurricane Milton Insurance Lawyer can help assess whether specific damages fall under policy terms.

Policies may have varying deductibles and limits for hurricane-related damages. It’s crucial to review the policy language to understand coverage scope and avoid unexpected out-of-pocket costs.

Common Reasons Insurance Claims Are Denied

Claims often get denied due to a lack of coverage for specific damage types, such as flooding without separate flood insurance. Another common reason is insufficient or inaccurate documentation proving the claim. Insurance adjusters may reject claims if damage timelines or causes are unclear.

Delays in filing claims or failing to comply with policy requirements, such as timely notice to the insurer, also result in denials. Sometimes insurers deny claims citing “pre-existing damage” or “wear and tear.”

A Hurricane Milton Insurance Lawyer – Larry Moskowitz, PA, can challenge wrongful denials by identifying policy violations or incomplete investigations by the insurer.

Importance of Accurate Documentation

Detailed records play a critical role in insurance claim success. Policyholders should take photos and videos immediately after Hurricane Milton to capture all visible damage—written inventories of damaged property, including approximate values, support compensation requests.

Keeping copies of correspondence with insurers, repair estimates, and receipts for emergency expenses strengthens the claim. Documenting communication dates and times can address disputes over compliance with policy procedures.

An attorney specializing in Hurricane Milton insurance claims often advises clients on specific documentation that best supports their case during negotiations or legal actions.

Role of a Hurricane Milton Insurance Lawyer

A Hurricane Milton insurance lawyer plays a crucial role in guiding clients through complex insurance claims. They ensure injured parties understand their rights and secure the full compensation owed under their policies.

How a Lawyer Can Help Maximize Your Compensation

An experienced lawyer like Larry Moskowitz, PA, reviews insurance policies in detail to identify all available coverages. He documents damages thoroughly, providing evidence such as repair estimates, medical reports, and expert opinions.

He negotiates with the insurance company to avoid lowball offers. The lawyer also calculates indirect damages, like temporary housing costs or lost income, to present a comprehensive claim. This approach often leads to higher settlements than policyholders might obtain alone.

What to Expect During the Claims Process

Clients should prepare for a process that involves paperwork, inspections, and communication with the insurer. Larry Moskowitz, PA, coordinates these tasks efficiently to meet all deadlines and requirements.

If the insurer requests additional information or delays payment, the lawyer handles these interactions to prevent stalling. He keeps clients informed of claim status and next steps, reducing stress and confusion throughout.

Legal Strategies for Disputed Claims

When claims are disputed or denied, a lawyer investigates the reasons behind the insurer’s decision. Larry Moskowitz, PA, may request an independent appraisal or legal review of disputed items.

He also prepares formal demand letters or files lawsuits if necessary to enforce policy terms. Throughout dispute resolution, the lawyer uses negotiation and litigation tactics to protect clients’ interests and challenge unwarranted denials.

Choosing the Right Legal Representation

Selecting the proper legal counsel is essential for navigating insurance claims after Hurricane Milton. Knowing which qualities matter, understanding a firm’s approach, and asking pertinent questions ensure clients make informed decisions.

Qualities to Look for in an Insurance Lawyer

An effective insurance lawyer should have extensive experience with hurricane-related claims. They must understand complex policy language and demonstrate a proven track record of recovering fair compensation.

Strong negotiation skills are crucial, as insurers often aim to minimize payouts. The lawyer should communicate clearly and promptly, keeping clients informed throughout the process.

Look for a lawyer who offers personalized attention rather than a one-size-fits-all approach. Transparency about fees and costs upfront also prevents surprises later.

Working with Hurricane Milton Insurance Lawyer – Larry Moskowitz, PA

Hurricane Milton Insurance Lawyer – Larry Moskowitz, PA, firm focuses on evaluating damages accurately and advocating for client rights against insurance companies.

They provide thorough claim assessments and handle disputes to ensure fair settlements. Their approach balances aggressive negotiation with practical advice tailored to each case.

Larry Moskowitz, PA, emphasizes clear communication and quick responsiveness. Clients receive dedicated support from initial consultation through claim resolution.

Questions to Ask Before Hiring

Before hiring, clients should ask about the lawyer’s experience with hurricane insurance claims specifically. Inquire how many cases they have handled and their success rate.

Clarify fee structures, including whether the lawyer works on a contingency basis or charges upfront. Understanding this prevents unexpected costs.

Ask how the lawyer plans to handle communications with the insurance company and what the typical timeline for a claim is. This sets realistic expectations.

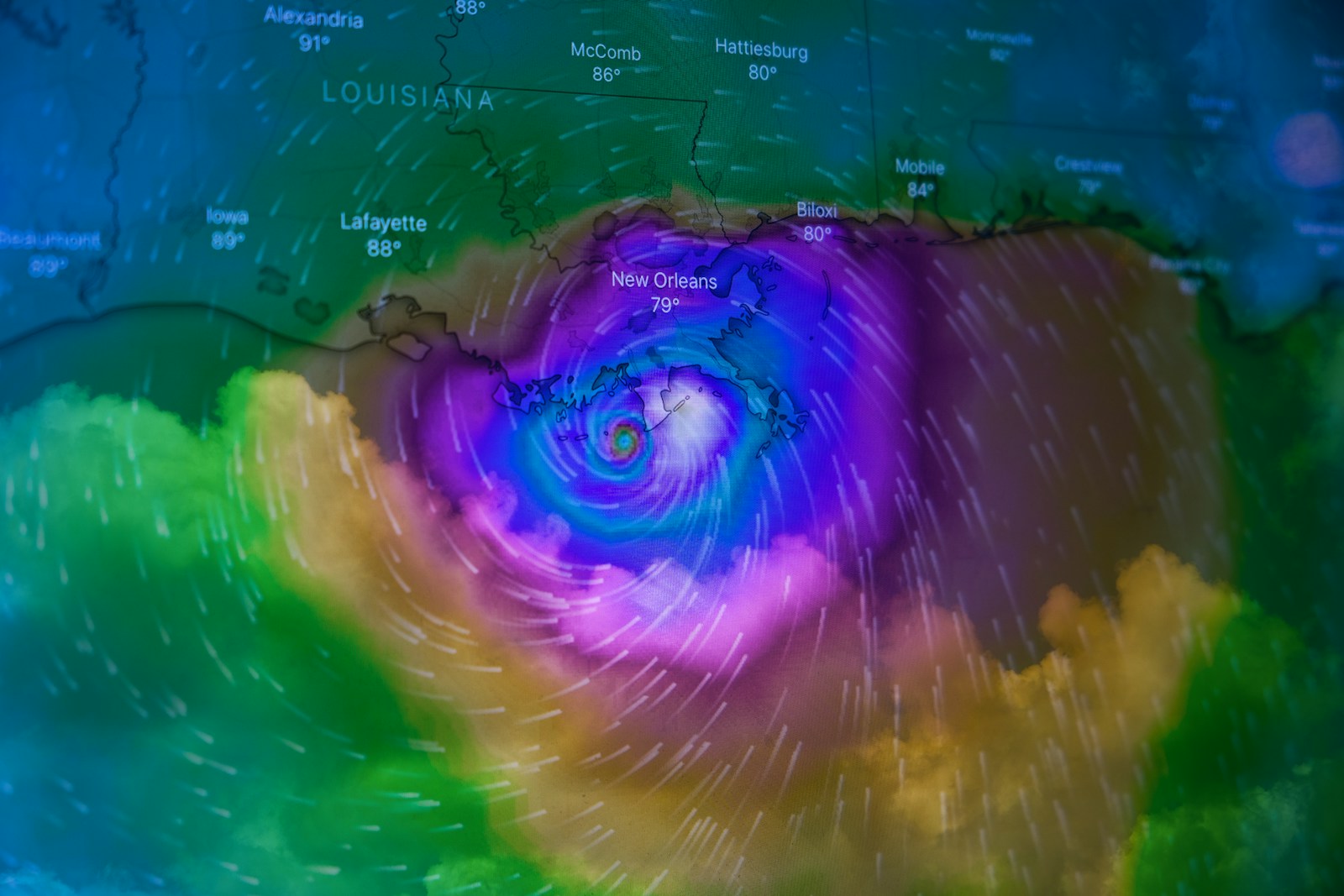

Photo by Brian McGowan; Unsplash