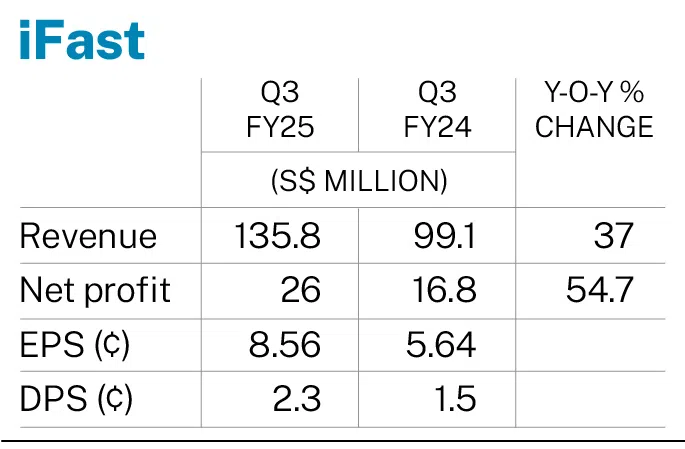

iFast Q3 net profit rises 54.7% to S$26 million on overall revenue growth

[SINGAPORE] Digital bank and wealth management platform iFast posted a 54.7 per cent rise in net profit to S$26 million for its third quarter ended Sep 30, from S$16.8 million in the previous corresponding period.

Earnings per share stood at S$0.0856 for the quarter, up from S$0.0564 the previous year.

Meanwhile, revenue was up 37 per cent year on year at S$135.8 million, from S$99.1 million.

The company on Friday (Oct 24) said its increased profitability was driven by growth in its Hong Kong ePension business, continued improvement in its core wealth management platform business, and the turnaround of iFast Global Bank.

Its board of directors proposed a dividend of S$0.023 per share for Q3, 53.3 per cent higher than the S$0.015 paid out in the year-ago period. The dividend will be issued on Nov 19, after the record date on Nov 6.

The group’s assets under administration expanded 29.6 per cent on the year, reaching a record S$30.62 billion in Q3.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

This came amid its wealth management markets in Singapore, Hong Kong, Malaysia and China hitting peaks as well.

Singapore continued to be the key contributor to iFast’s assets under administration, with the B2B division recording a 25.8 per cent rise on the year.

Net inflows reached an all-time high as well at S$1.49 billion, marking an 83.6 per cent year-on-year rise.

Meanwhile, the iFast Global Bank segment recorded net profit of S$310,000 in Q3, reversing from a loss of S$820,000 in the previous corresponding period.

iFast Global Bank turnaround

The turnaround came on the back of healthy growth in net interest revenue as deposits continued to grow, alongside continued increases in non-interest commission and fee income, said iFast.

The group is optimistic the bank will be able to post full-year profitability, following the initial period in the black that was Q4 2024.

Customer deposits surged 92.7 per cent to S$1.55 billion in the latest period under review, with the digital personal banking division the main driver of this expansion.

As at Sep 30, the bank’s liquidity coverage ratio was 617 per cent, its net stable funding stood at 200 per cent, and the total capital ratio was 23.7 per cent – all higher than minimum regulatory requirements.

The bank intends to maintain capital and liquidity ratios “well above” such required levels, iFast noted. Despite this, the group overall will be able to aim for “very healthy” levels of returns on equity, as the revenues derived from the core platform business and ePension division are “essentially fee-based income”, it added.

The group expects robust growth rates in revenues and profitability for 2025, compared with the previous year.

It said that improvements will be driven by its ePension business, alongside better growth momentum in the core wealth management business, and the bank’s first full year of profitability.

For the first nine months of the year, net profit was up 41.8 per cent at S$67.2 million from S$47.4 million in the year-ago period.

Revenue expanded 30.2 per cent year on year to S$363 million from S$278.9 million.

Shares of iFast closed 0.1 per cent or S$0.01 lower at S$9.23, before the release of the results.