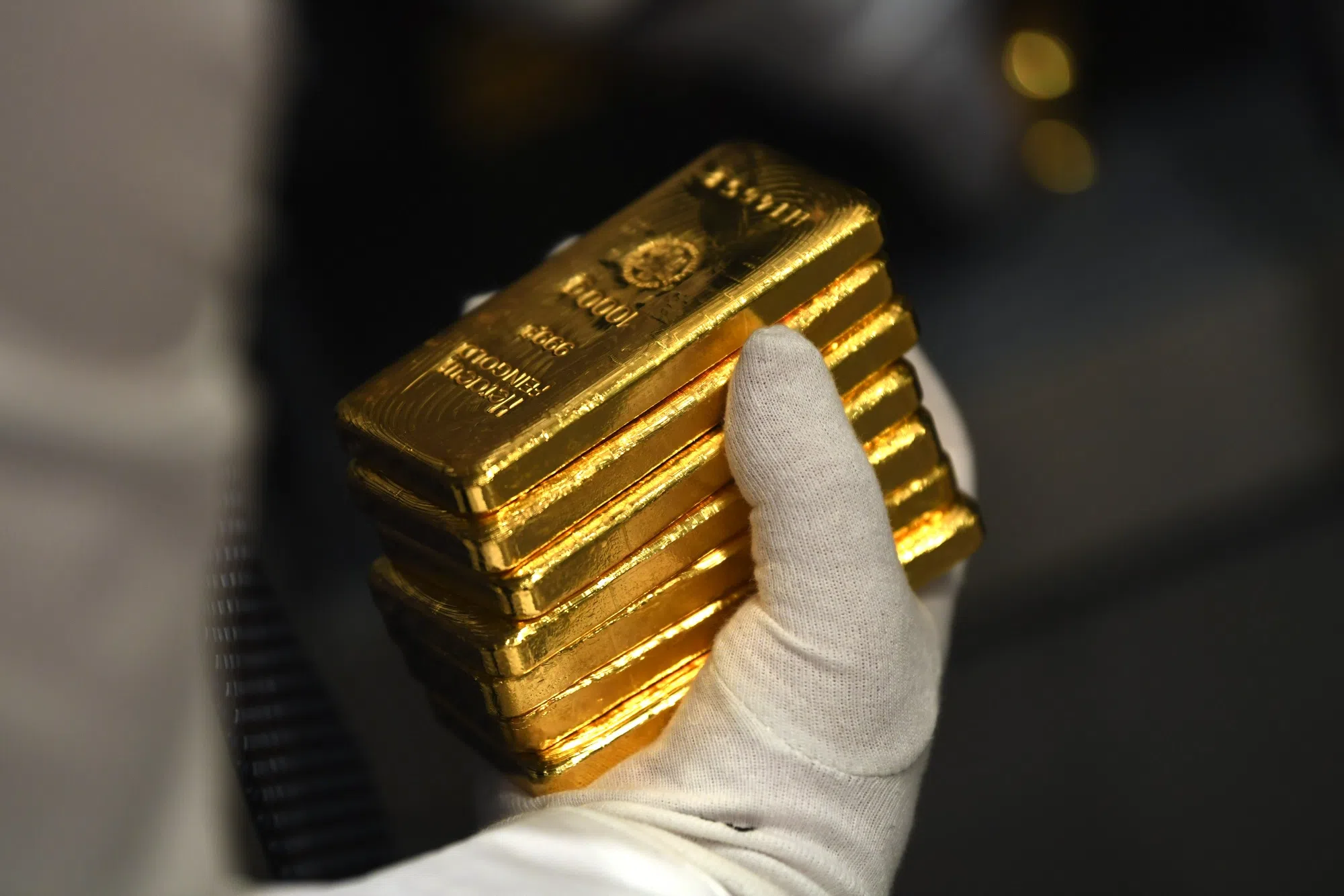

GOLD prices climbed on Thursday (Apr 18) as concerns about the Middle East war extending to other regions boosted demand for the safe-haven metal.

Spot gold was up 0.4 per cent at US$2,369.93 per ounce, as at 0107 GMT. US gold futures dipped 0.1 per cent to US$2,385.10 per ounce.

Israel will make its own decisions about how to defend itself, Prime Minister Benjamin Netanyahu said, as Western countries pleaded for restraint in responding to a volley of attacks from Iran.

US economic activity expanded slightly from late February to early April and there were fears among firms that progress in lowering inflation would stall, a Federal Reserve survey showed.

Cleveland Federal Reserve Bank president Loretta Mester said she expects price pressures to ease further this year, allowing the Fed to reduce borrowing costs, but only when it is “pretty confident” inflation is heading sustainably to its 2 per cent goal.

Lower interest rates boost the appeal of holding non-yielding bullion.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The European Central Bank (ECB) would be putting a dampener on the economy even after cutting interest rates twice, but there is no rush to slash borrowing costs, ECB policymaker Mario Centeno said.

The global silver deficit is expected to rise by 17 per cent to 215.3 million troy ounces in 2024 due to a 2 per cent growth in demand, led by a robust industrial consumption and a 1 per cent fall in total supply, the Silver Institute Industry Association said.

Amid a flurry of commentary from global financial leaders at the International Monetary Fund and World Bank Spring meetings in Washington, and with many markets having undergone huge moves in recent weeks, investors are taking a bit of a time out.

Spot silver rose 0.2 per cent to US$28.28 per ounce, platinum edged 0.3 per cent higher to US$940.55 and palladium was listless at US$1,026.25. REUTERS