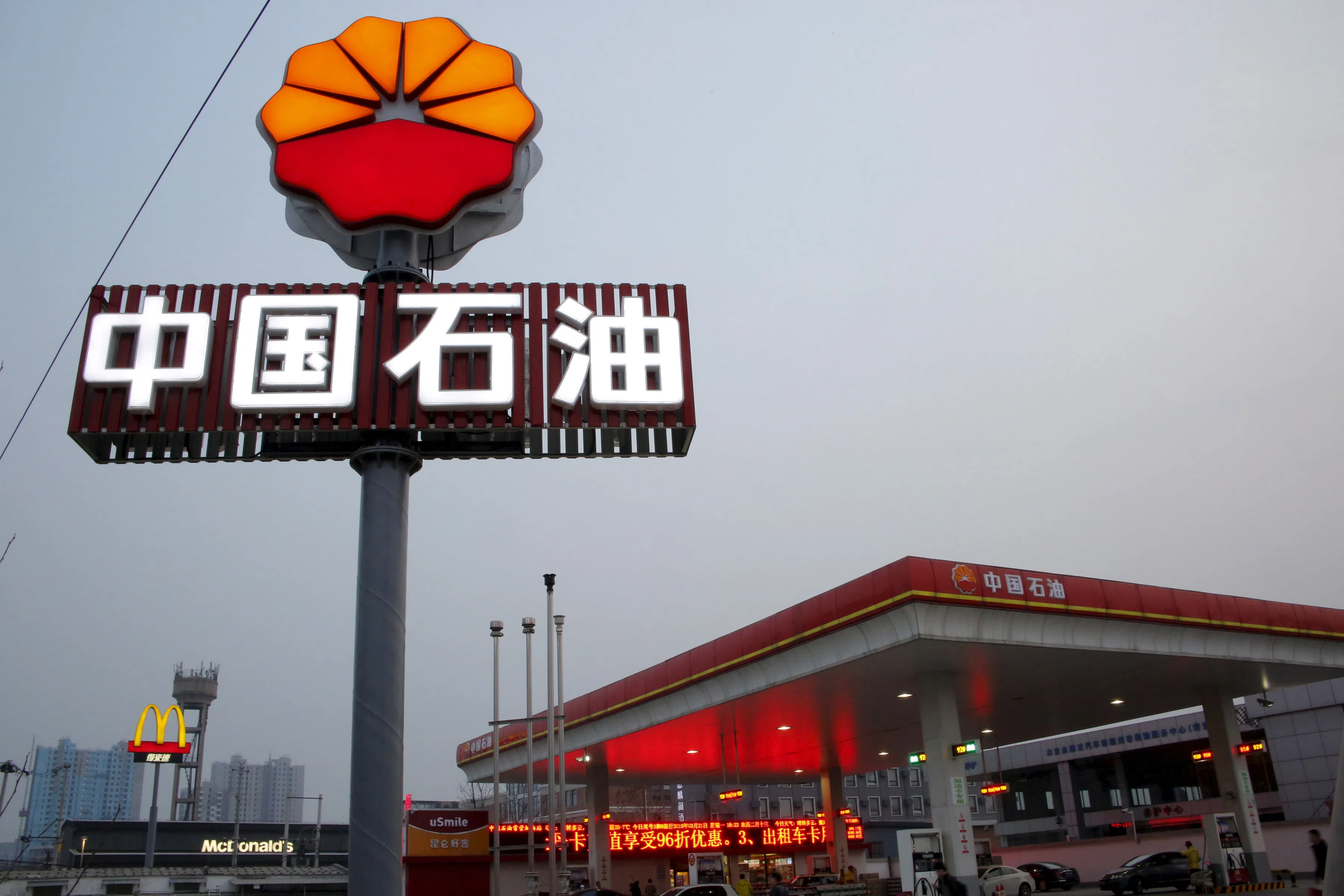

PetroChina profit rises as economic recovery remains uneven

PetroChina recorded its highest first-quarter profit amid steady global oil prices and even as China’s economic rebound struggles to gain traction.

China’s largest oil and gas producer said net income was 45.7 billion yuan (S$8.58 billion) in the first three months of 2024, according to an exchange filing on Monday (Apr 29). That compares with 43.6 billion yuan in the same period last year. Revenue increased by 11 per cent to 812 billion yuan.

Increased profits from PetroChina’s drilling and natural gas segments were more than enough to offset declines in refining and marketing. The results mirror those of its state-owned sister firms, as upstream-focused Cnooc posted record quarterly profits while downstream-focused Sinopec saw first-quarter earnings decline from the year before.

Beijing has leaned on PetroChina and its fellow state-owned majors in recent years to maintain oil output and boost gas production to keep the country from becoming too dependent on imported energy. The company saw its output for the quarter increase by 1.4 per cent for oil and 3.9 per cent for gas.

Global oil prices were just slightly lower in the first quarter of 2024 than the previous year. PetroChina has also benefited from looser rules for domestic natural gas prices that allow it to pass on more of its import costs to customers.

China’s economy continues to show an uneven recovery from Covid-era restrictions. Road and air traffic have rebounded, including record holiday travel during the Lunar New Year holiday. But the property sector remains weak, weighing on demand for industry-intensive products like diesel and chemicals.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Capital expenditure for the quarter was up 10 per cent from the previous year to 56 billion yuan. BLOOMBERG