SEMICONDUCTOR company UMS Holdings : 558 0% posted a net profit of S$9.8 million for the first quarter of its 2024 fiscal year, a 44 per cent drop from S$17.4 million in the same period a year ago.

The decline came on the back of weak semiconductor sales amid a global slowdown in the industry.

Revenue fell 33 per cent to S$54 million, compared to S$80.8 million a year ago. Due to the softer performance, earnings per share dipped to 1.41 Singapore cents, compared to 2.59 Singapore cents in the same quarter last year.

Semiconductor sales dropped 37 per cent owing to softness in the company’s semiconductor integrated systems, as well as components segments.

Sales of semiconductor integrated systems fell 48 per cent due to high inventory of one of its key customers, while component sales slipped 24 per cent.

Revenue also fell 12 per cent in other segments due to the weaker material and tooling distribution business.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The aerospace business, however, bucked the trend, with sales growing 22 per cent compared to a year ago.

The company managed to increase its gross material margins by three percentage points to 53.2 per cent, mainly due to the change in product mix. Expenses also dropped as it cut personnel costs and as utility bills came in lower.

The board has declared an interim dividend of 1.2 Singapore cents per share, higher than the one cent per share last year.

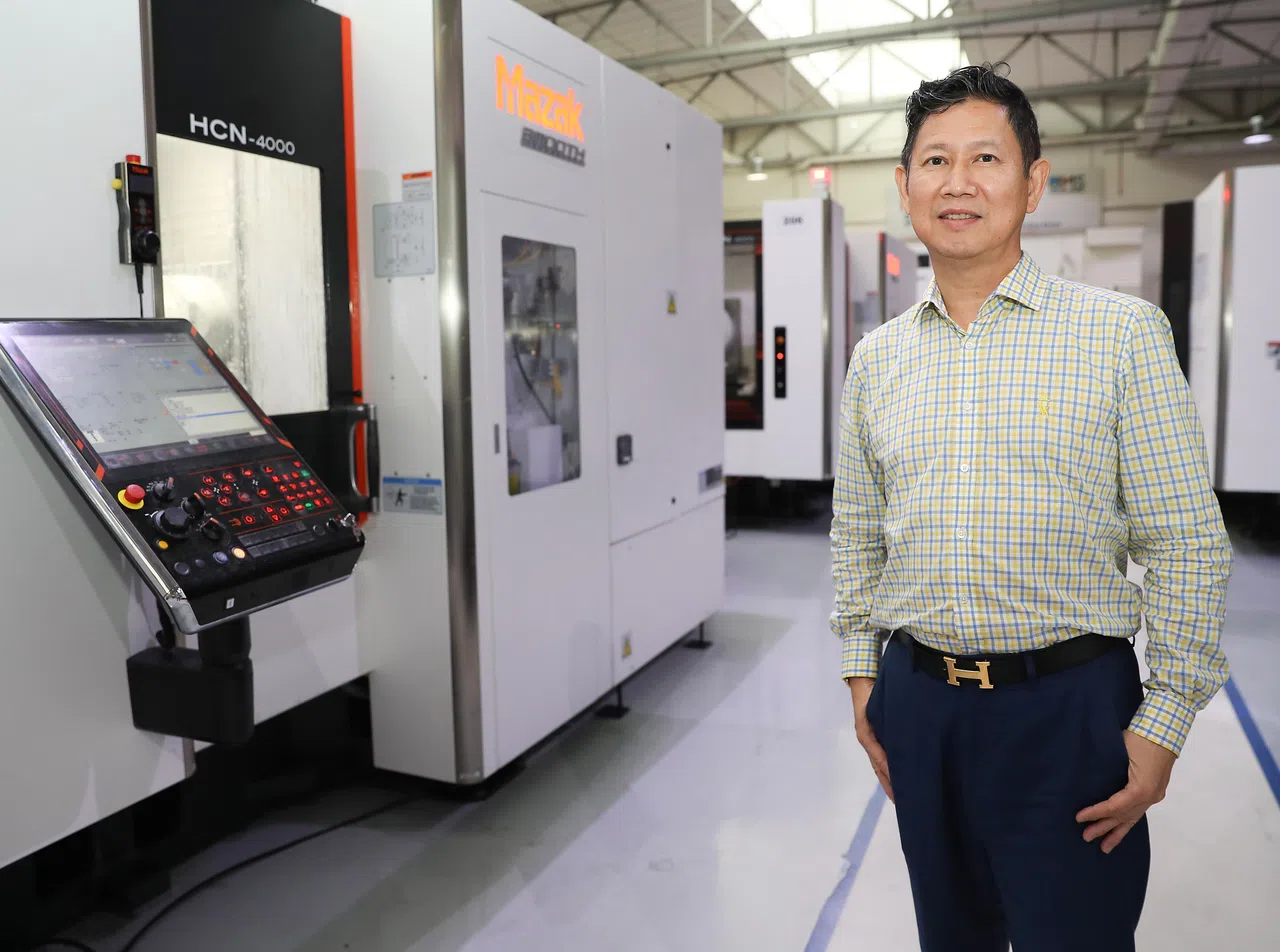

UMS chief executive officer Andy Luong said the company has taken actions to drive revenue, acquire new customers and improve working capital to enhance its ability to capture new growth opportunities.

Global production resources continue to shift their focus towards South-east Asia, in particular Malaysia, where UMS recently completed construction of a 300,000 sq ft factory in Penang.

“While our semiconductor sales slowed in the first quarter of the year, the pace of decline has moderated as the outlook continues to brighten. We have taken the right initiatives to beef up our production capabilities and strengthened our capital base,” Luong said.

Shares of UMS rose 1.5 per cent or S$0.02 to close at S$1.32 on Friday.