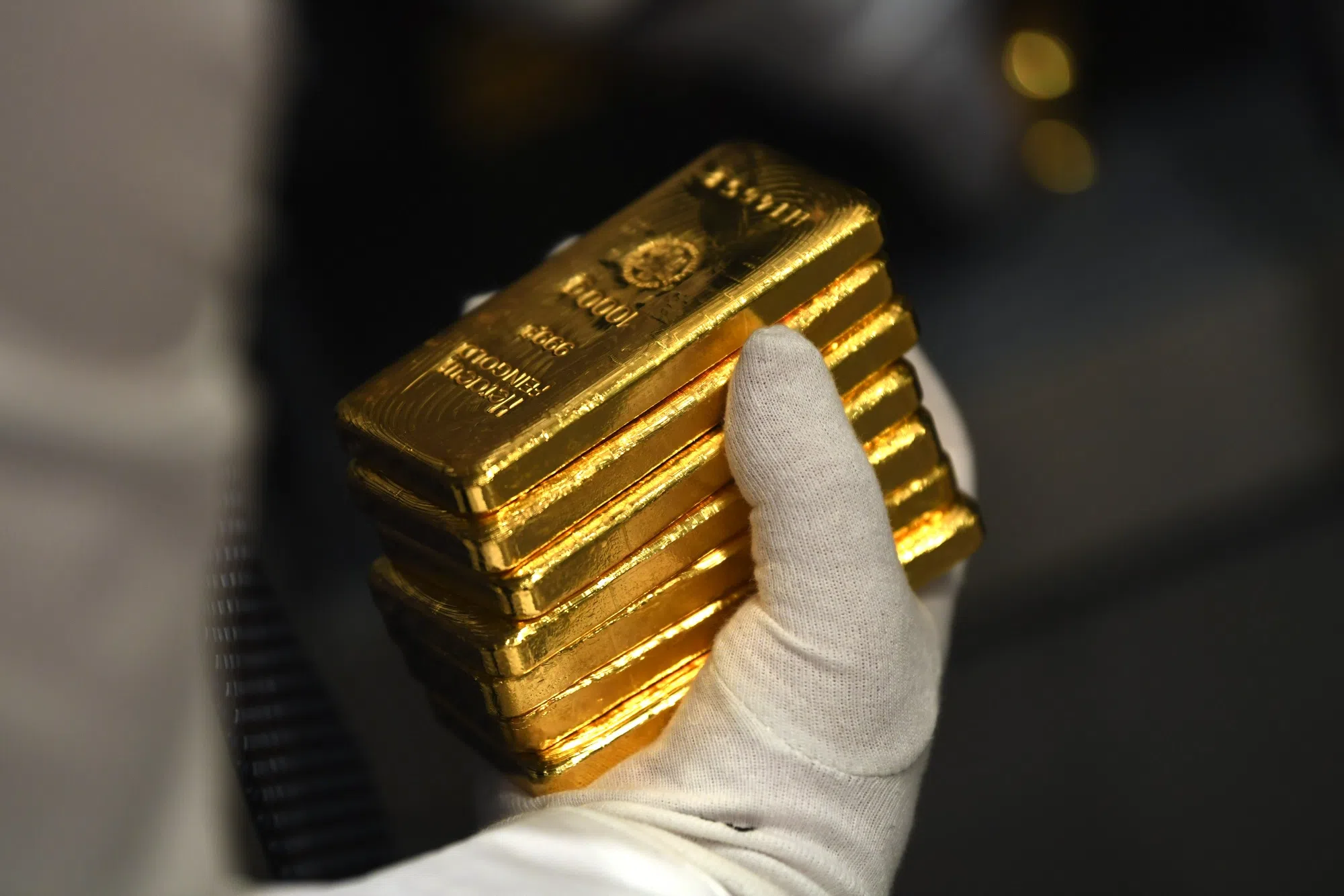

GOLD prices edged up on Friday (May 31) and were on track for a fourth straight monthly gain, while investors awaited a key US inflation reading that could provide further insights into the Federal Reserve’s policy path.

Spot gold was up 0.2 per cent at US$2,346.18 per ounce, as at 0141 GMT. Bullion prices are up 0.5 per cent so far this week.

US gold futures rose 0.1 per cent at US$2,345.20.

Gold prices have gained 2.7 per cent so far this month after hitting a record high of US$2,449.89 on May 20.

Fed policymakers continue to expect inflation to fall this year even as the labour market stays strong, leaving them in no hurry to cut the policy rate from the 5.25 to 5.5 per cent range they have kept it in since last July.

Investors are now awaiting the April reading on the personal consumption expenditures price index, the Fed’s preferred inflation gauge, due at 1230 GMT.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Traders’ bets signalled growing scepticism that the Fed will cut rates more than once in 2024, currently pricing in about a 64 per cent chance of a rate cut by November, according to the CME FedWatch Tool.

Bullion is known as an inflation hedge, but higher rates increase the opportunity cost of holding non-yielding gold.

Russian mining and metals giant Nornickel lowered its forecast for the global nickel surplus this year, but said it expected a bigger global palladium deficit.

Days after miner BHP launched its takeover bid for rival Anglo American in April, the CEOs of both headed for South Africa, where a condition to divest Anglo’s local platinum and iron ore assets was causing a political storm.

Spot silver fell 0.2 per cent to US$31.11 per ounce, platinum was down 0.2 per cent at US$1,022.70 and palladium lost 0.2 per cent to US$946.25. REUTERS