THE iEdge S-Reit Leaders Index has declined 12.3 per cent for the year to May 29, while it’s total return is a negative 9.5 per cent.

The 22 constituents of the index have generated total returns ranging from a positive 1.3 per cent for Aims Apac Reit : O5RU 0% to a negative 25.2 per cent for CapitaLand China Trust : AU8U 0%.

Over the period, the 22 constituents booked just over S$790 million of combined net institutional outflow. Only Digital Core Reit : DCRU 0%, Frasers Centrepoint Trust : J69U 0% and ESR-Logos Reit : J91U 0% bucked that trend and booked net institutional inflow.

In the wake of its decline, the iEdge S-Reit Leaders Index now has a trailing-12-month distribution yield of 6.5 per cent.

The iEdge S-Reit Leaders Index is the most liquid representation of the Singapore real estate investment trust (Reit) market. It is an adjusted free-float market capitalisation weighted index that measures the performance of the largest and most tradable Reits in Singapore.

Since the end of 2022, the iEdge S-Reit Leaders Index averaged absolute daily price changes of +/- 0.6 per cent. The average daily trading range over the period was 1.1 per cent.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The iEdge S-Reit Leaders Index has maintained a significant 0.98 correlation to the FTSE ST Reit Index and 0.99 correlation to the iEdge S-Reit Index since the end of 2022.

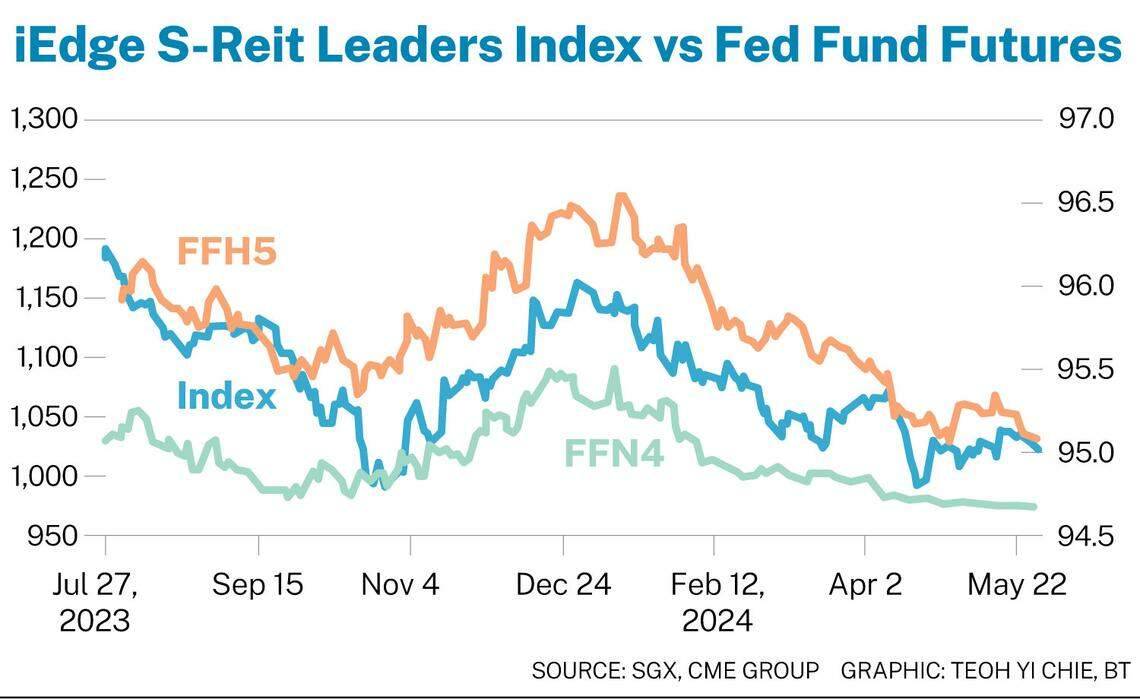

There has also been a directional correlation to the outlook for the US federal funds rate (FFR), in line with the global Reit market. Paralleling the importance of US interest rates and the US dollar on the global economy, US Reits have a significant impact on the global Reit market. US-listed Reits have a weight of 70 per cent in the FTSE EPRA Nareit Global Real Estate Index.

The price of CME Federal Funds futures as at May 29 indicated that the market expects the FFR to be 5.33 per cent at the end of July.

This expectation is within the FFR’s current band of 5.25 to 5.5 per cent, and is also above the expectations earlier this year. On Jan 10, the futures price indicated an expected rate of 4.5 per cent by the end of July.

Before the end of March 2025, however, the expectations are for rate cuts of 50 basis points and possibly even 75 basis points from the current band.

Recent Reit performances have also been impacted by proactive capital management, utilities costs, exchange rates, property valuations and earnings.

For instance, the Q1 2024 earnings season in the United States saw two US Reits beat estimates for every one that missed. This boosted the performance of US Reit indices, which gained 7 per cent gains in US dollar terms from Apr 16 to May 15.

The March 2024 SGX iEdge S-Reit Leaders Index Futures Contract declined 8 per cent from 1,149.0 at the end of 2023 to 1,056.6 on Mar 27.

The June 2024 SGX iEdge S-Reit Leaders Index Futures Contract declined 3.1 per cent from 1,056.6 on Mar 27 to 1,024.2 on May 29.

The SGX iEdge S-Reit Leaders Index Futures Contracts have a contract multiplier of S$25.

This means an index value of 1,000 provides S$25,000 in notional exposure to the index.

The contracts do not pay distributions. Their theoretical pricing will therefore be lower in the months when index heavyweights have ex-dates with distributions, than in those months that have no distributions.

The SGX iEdge S-Reit Leaders Index Futures Contracts are traded on the nearest two serial months and a quarterly cycle of March, June, September and December; with expiries on the penultimate Singapore business day of each quarter. Note that while the SGX iEdge S-Reit Leaders Index Futures Contracts are not actively traded, they are supported by market makers. SGX RESEARCH

The writer is the market strategist at Singapore Exchange (SGX). For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.

Source: SGX Research S-Reits & Property Trusts Chartbook.