ONE in 10 contact lenses used globally comes from Singapore, as does one in five cardiac-related implants such as surgical structural heart valves, pacemakers and stents.

The Republic also produces half the mass spectrometry systems used worldwide to test for a range of things such as drugs or food contamination, and 90 per cent of gene chips that allow scientists to evaluate and store large amounts of genetic data.

Made-in-Singapore medical devices are not the only ones punching above their weight in this growing market that the Economic Development Board (EDB) estimates will hit US$225 billion by 2030 in Asia alone.

An EDB spokesman said Singapore’s medical technology, or medtech, sector has been growing steadily, with a manufacturing output of S$19 billion in 2022 – a S$2 billion increase over 2021. In 2012, it was S$5 billion.

There are now more than 400 medtech companies here, employing over 16,000 people – mostly highly skilled technicians, although there is a fair share of scientist-researchers.

John Eng, EDB’s vice-president of the healthcare division, said: “EDB, together with other government agencies, has worked to develop and grow the industry for over 20 years.”

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

This entailed building a conducive environment and skilled manpower to support the needs of this highly skilled sector.

The goal was to get healthcare companies “to locate key activities with decision-making control to drive market access and business growth”, he said.

“Today, the medtech sector is a key pillar of Singapore’s healthcare industry and offers a variety of different jobs for Singaporeans,” Eng added.

More than 50 foreign medtech companies have set up regional headquarters here, while multinational corporations account for over 35 manufacturing plants.

One of the latest to join this growing industry is Germany’s Biotronik, which opened a 20,000 sq m site in Kallang Way in December 2023. It is the first major manufacturer in the cardiac rhythm management sector to set up an Asia-Pacific manufacturing and research hub.

Another recent major investment was by Leica Microsystems, also a German company, which opened its S$82 million manufacturing and research and development (R&D) facility for surgical microscopes in October 2023.

The intellectual property protection Singapore provides is another strong pull factor.

As a result, there are now more than 25 medtech R&D centres. Work by these centres ranges from upstream clinical needs to product and process development, including software and digital capabilities.

One R&D effort making waves globally is EssilorLuxottica’s spectacle lenses for myopia. The French company has about 50 scientists and engineers working on myopia research and product development here.

About 70 per cent of its team of 50 scientists and engineers are local. They work closely with the Singapore National Eye Centre and Singapore Eye Research Institute.

Bastien Feret, who heads EssilorLuxottica’s R&D Centre for Innovation & Technologies, said Singapore was a logical choice, not only due to the high level of myopia here, but also for the vibrant research that already exists and the availability of a highly skilled workforce.

Its Singapore centre has been instrumental in establishing the group as a global leader in myopia research, he said.

Launched globally in 2020, the Singapore-developed Stellest lenses can correct vision and slow the progression of myopia by an average of 67 per cent when worn by children for 12 hours a day, compared with normal spectacle lenses, said the company.

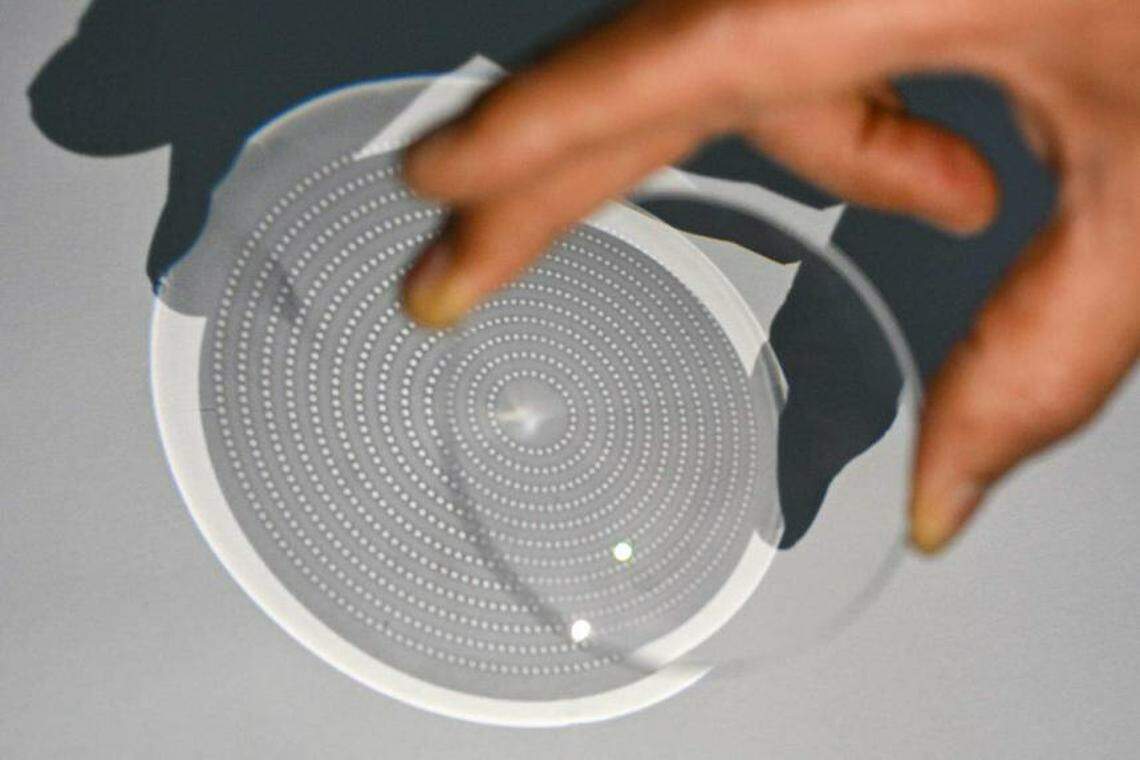

While it corrects vision, the Stellest lens also contains 1,021 lenslets, or tiny lenses, set in concentric circles that create extra out-of-focus areas. These signal to the eye to slow down growth – and thereby the progression of myopia.

Excessive eye growth, or elongation of the eyeball, causes myopia.

Eng said results like this have “built up Singapore’s track record and standing as a trusted hub for the development and launch of key medical device and life science tools product lines, while also creating exciting opportunities for Singaporeans to innovate and make an impact on healthcare in Asia and global markets”.

Given Asia’s large and ageing population, the demands for medtech solutions such as hearing aids and pacemakers will grow. EDB said that by 2030, Asia will account for 60 per cent of the world’s population, with one in four aged 60 or above and at higher risk of living with a chronic disease.

Its spokesman added: “Many medtech companies are turning their attention to Asia, with Singapore becoming a preferred base from which these medtech companies serve the region’s growing healthcare needs and deliver improved treatment outcomes.” THE STRAITS TIMES