The Bank of Japan offered to purchase a smaller amount of government bonds in a regular operation on Monday (May 13) than it did on April 24 as it seeks to reduce its presence in the country’s debt market.

The move is likely to put upward pressure on Japanese bond yields, potentially narrowing the wide yield gap between Japan and the US that has undermined the yen. The yields for the benchmark 10-year maturity rose immediately after the announcement from the BOJ while the yen trimmed earlier losses. The 30-year yield also reached its highest since 2011 at 2.03 per cent in late afternoon trading.

The central bank said it would buy 425 billion yen (S$3.69 billion) of 5-to-10 year debt, compared with the 475.5 billion yen it bought in the operation last month. That’s still within the planned range for the current quarter. This was the first reduction in the buying amount since late December.

“It’s quite a surprise that the BOJ cut the amount, and that would probably help boost yields,” said Takahiro Otsuka, senior fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities. “It’s hard not to see the reduction as a response to the recent depreciation of the yen. More volatility may hit the bond market.”

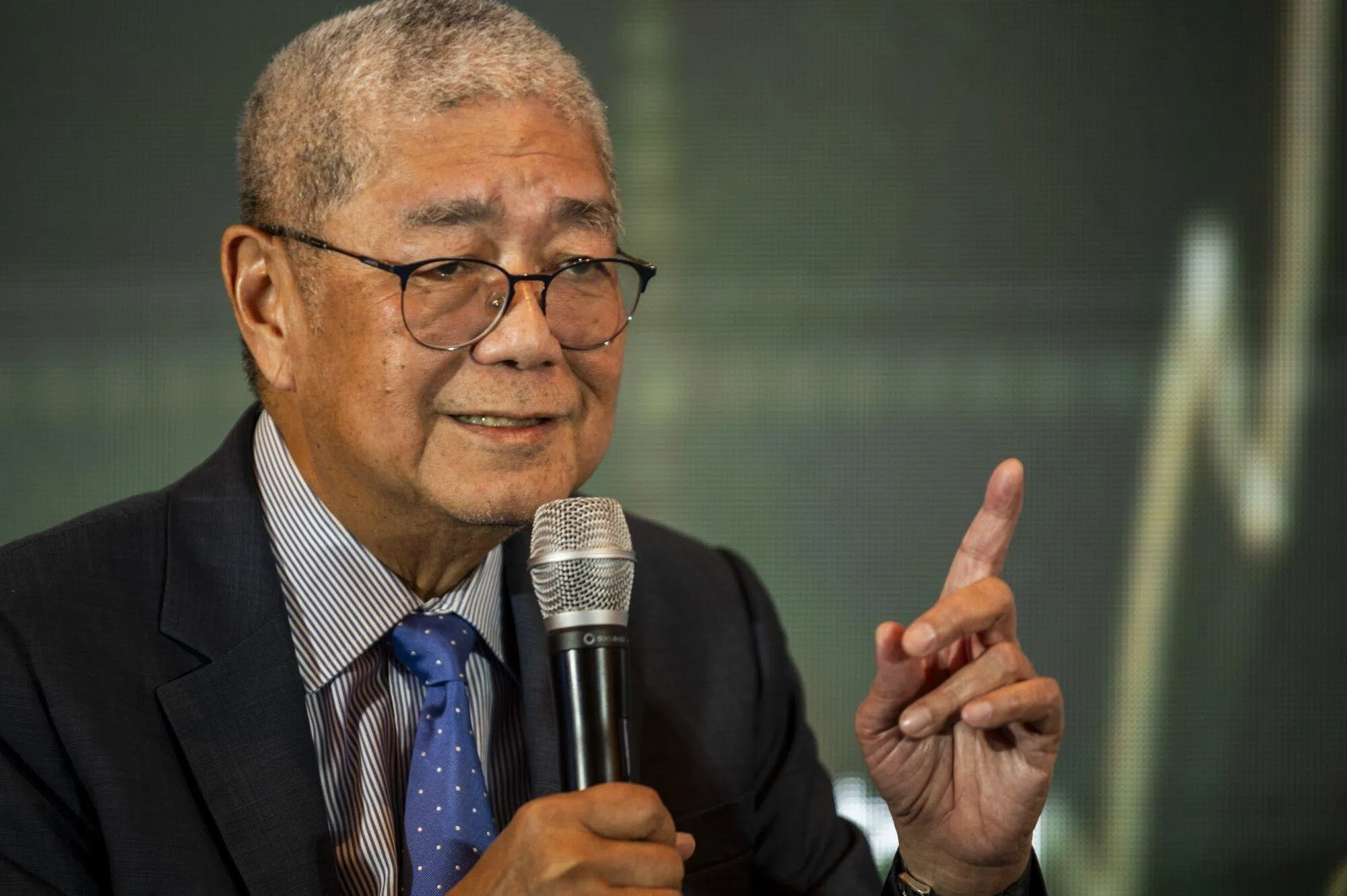

Governor Kazuo Ueda said in March that the BOJ’s new approach is to use short-term interest rate as the primary policy tool rather than using bond purchase operations or the central bank’s debt holdings.

A summary of the BOJ’s April policy meeting released last week indicated that board members are closely looking at the weak yen’s impact on inflation and seeing the potential for faster interest rate hikes as a result, boosting speculation the BOJ will raise rates sooner rather than later and cut debt-buying amount.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“The BOJ seems to be under pressure from the government” to take action in response to the yen’s slide and easy financial conditions, said Shoki Omori, chief desk strategist at Mizuho Securities in Tokyo. “Still, the impact would be limited as investors were somewhat prepared for this since the release of the last summary of opinions from the BOJ’s April policy meeting.”

The yen trimmed earlier losses of as much as 0.1 per cent against the dollar to trade steady at 155.81 after the announcement, while futures of the nation’s 10-year sovereign notes extended declines. Japan’s benchmark 10-year yield rose four basis points to 0.94 per cent Monday, moving toward a decade high of 0.97 per cent reached in November. BLOOMBERG