🧢 Recap

Before we jump into examples, here’s a recap of what investment portfolios are all about:

A portfolio is a collection of valuable assets you own for investing

These assets can include stocks, bonds, investment funds, property or even rare Pokémon cards

Constructing a portfolio is about deciding how you want to allocate your savings to different assets

Your financial goals will inform the duration of your investments and how much risk you can afford to take

A great portfolio can help you meet those goals by getting you as high a return as possible for the amount of risk you can take

And now, on to the examples! We’ll start with a classic.

🥧 The 60-40 portfolio

This portfolio is the investment world’s equivalent of what an AIRism oversized tee from Uniqlo is to the Singaporean man. (Likewise, I’m 100 per cent on board with the idea that a Uniqlo tee is suitable for every occasion and yes, I’m willing to die on that hill.)

The 60-40 portfolio has been a mainstay of investors’ portfolios for the simple reason that it has worked well historically.

Since this type of portfolio was developed in 1961, it has had an average annual return of over 9 per cent.

The idea is that the portfolio balances the higher risk and higher return potential of stocks with the stability and lower volatility of bonds.

Having a mix of stocks and bonds also helps reduce volatility by reducing the chance that your investments crash significantly in any given year.

That’s because stocks and bonds have historically had a low correlation – i.e. when prices of stocks fall, bond prices tend to go up, and vice versa.

If you decide on this split, don’t be alarmed when you read about prophecies of doom for the 60-40 investors in the news ⚰️.

When the 60-40 portfolio lost money in 2022, its worst performance since the 2007-2008 global financial crisis, it seemed like everyone was calling for its death. Then, the portfolio rebounded the next year, and people started singing its praises again. Arguing about the 60-40 is just a weird obsession Wall Street has, I guess 🤷, but the basic principle of diversification still holds.

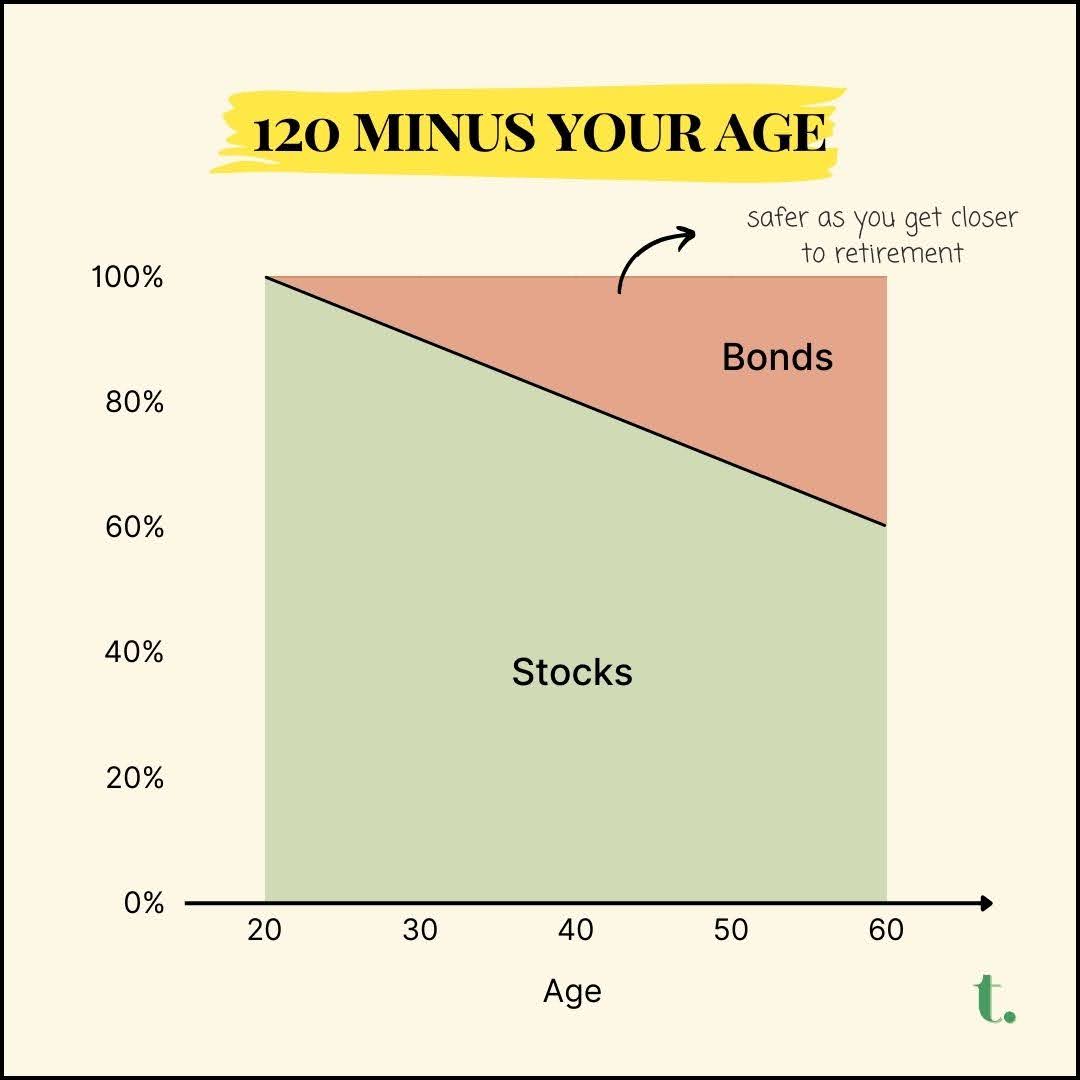

🔢 120 minus your age

No, this has nothing to do with age differences in your dating life. (You’re thinking of half your age plus seven.)

The rule of 120 is a common rule of thumb to figure out what percentage of your portfolio should be in stocks. Among its advocates was the late John Bogle, founder of one of the world’s largest investment companies Vanguard.

Here’s how it works 🔎:

At my current age of 28, I’ll take 120 minus 28, which gives me 92.

So going by this rule, I should keep 92 per cent of my portfolio in stocks and the remaining 8 per cent in bonds and cash.

The idea is that when you’re younger, you can afford to take more risk, so you hold more stocks. But as you get older and closer to retirement, you don’t want too much volatility in your portfolio, so your bond allocation increases.

There’s nothing special about the number 120. In fact, it used to be 100, then became 110, partly because average life expectancies have increased.

🛰️ Core-Satellite portfolio

This one’s a fairly popular portfolio in Singapore that DBS and Endowus have both advocated for.

Watch this video by DBS’ chief investment officer Hou Wey Fook, in which he explains the portfolio’s approach using fancy fine-dining dishes that I can only hope to afford one day 😋:

Simply put, the “core” 🌏 of your portfolio – usually about 80 per cent – is put in stable, long-term investments. These can be a diversified mix of stock index funds, bonds and real estate investment trusts.

The aim of the “core” is to meet your essential financial goals, which leaves you with the freedom to chase higher returns with the “satellite” portion of your portfolio.

This “satellite” 🛰️ – typically 20 per cent – can consist of individual stocks that you strongly believe will do well or exchange-traded funds (ETFs) of the hottest sectors, such as semiconductor or AI funds.

🧵 Make it work for you

So there you have it: three examples of how you can design your investment portfolio.

That’s not to say you must follow any of the examples to the letter.

If you’re fearful of losing money, taking a more conservative 50-50 split of stocks and bonds can help prevent you from making impulse decisions to exit your investments in a downturn.

Or, if you already have a large amount of money saved up, maybe you don’t need too big of a “core” and can afford to take bigger bets with your “satellite” assets.

Often, the best portfolio is the one that suits your particular needs – these examples are just meant to give you a good starting point for designing one that works for you.

TL;DR

The traditional 60-40 portfolio balances the higher return potential of stocks with the stability of bonds

The 120 minus your age rule gives greater return potential when you’re younger and stability as you age

The Core-Satellite portfolio ensures that you meet your essential goals while giving you the freedom to chase returns

The best portfolio is one that meets your individual needs and goals