WITH almost full certainty that the Federal Reserve will cut interest rates this September (based on CME Fed Watch Tool showing a 100 per cent probability as of Jul 26, 2024), interest rates continue to remain in the spotlight for Reits.

The Monetary Authority of Singapore (MAS) has just announced a proposal to simplify the leverage requirements for all Singapore Reits (S-Reits) – it proposes for a single aggregate leverage limit of 50 per cent and a minimum interest coverage ratio (ICR) of 1.5 times to be applied for all S-Reits.

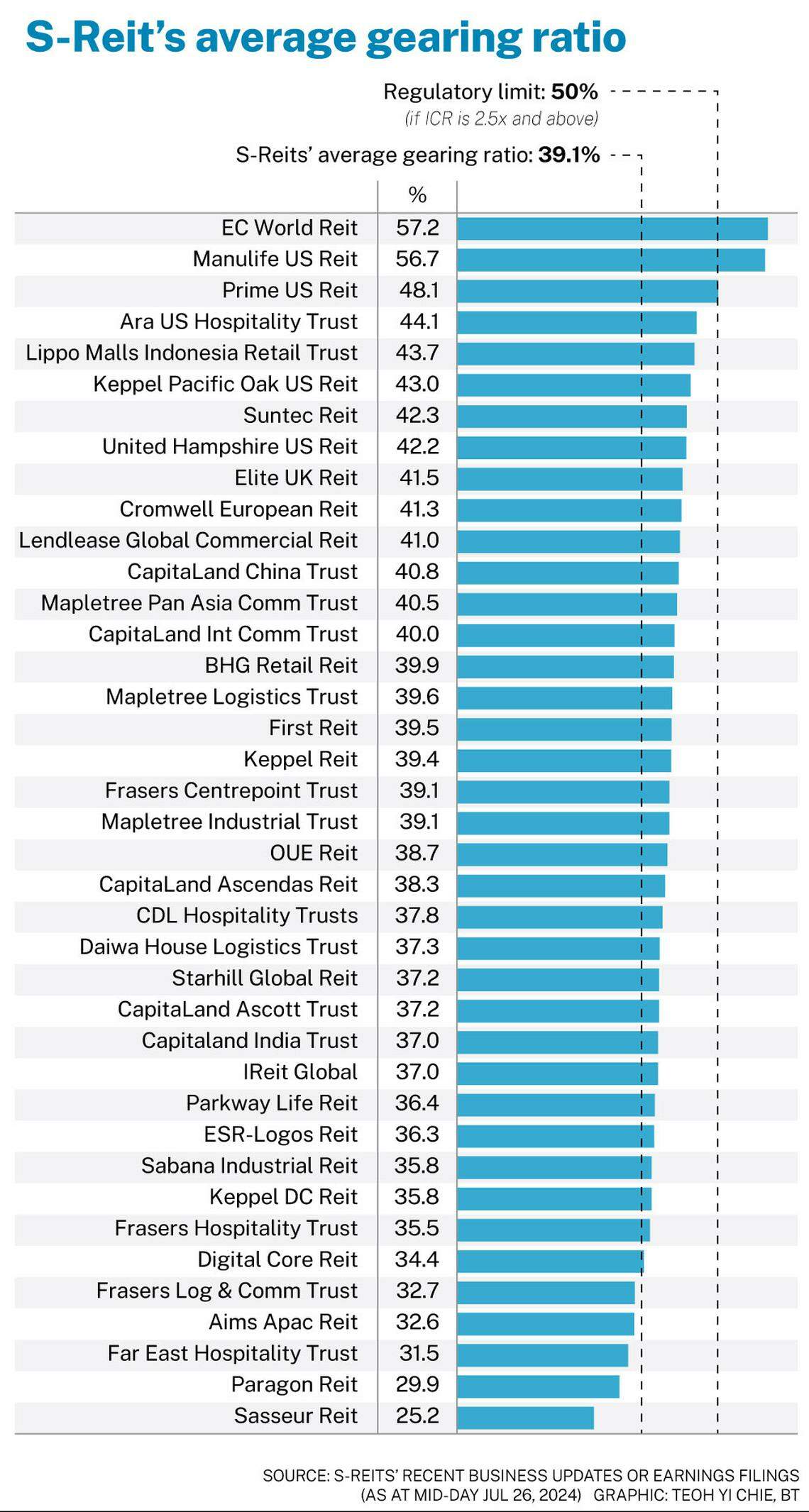

Currently, S-Reits have a leverage limit ratio of 45 per cent if the ICR is 2.5 times or below, and a limit of 50 per cent if the ICR is above 2.5 times.

MAS last increased the leverage limit in April 2020 to provide more flexibility for S-Reits to manage their capital structures during the Covid period.

The latest proposal is aimed at simplifying the leverage requirements, foster prudent borrowings, and ensures that Reits can adequately service debt obligations and have sufficient earnings to pay their interest expenses.

Today, S-Reits maintain an average gearing ratio of 39.1 per cent, based on latest company filings which were extracted at mid-day on Jul 26, 2024.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

More than half the sector has gearing ratios below the its average.

Five S-Reits that maintain the lowest gearing ratios are Sasseur Reit (25.2 per cent), Paragon Reit (29.9 per cent), Far East Hospitality Trust (31.5 per cent), Aims Apac Reit (32.6 per cent), and Frasers Logistics & Commercial Trust (32.7 per cent).

At 39.1 per cent and a regulatory limit of 50 per cent, this translates into over S$20 billion of potential debt headroom for the sector to fund capital-intensive acquisitions.

Most S-Reits today also report the ICR figures – which measure a Reit’s ability to pay interest on its outstanding debt – with the sector’s ICR at 3.8 times on average. 33 trusts have ICRs at 2.5 times and above, all trusts (based on reported ICR) have ICRs above 1.5 times.

Sabana Industrial Reit, the first S-Reit to report this earnings season, updated that its portfolio valuation had improved 3.3 per cent year on year (yoy) to S$914.5 million, supported by asset enhancement initiatives, asset rejuvenation and higher rentals.

Sabana Reit’s distributions per unit (DPU) for H1 2024 was at 1.34 cents and 16.8 per cent lower yoy.

However rental reversions improved 16.8 per cent for the period, marking its 14th consecutive quarter of positive reversions.

It has an aggregate leverage ratio of 35.8 per cent, an ICR of 3.3 times, and 80.1 per cent of its borrowings on fixed rates.

Gearing ratio, also known as aggregated leverage, is the ratio of a Reit’s total debt to its total assets.

This metric, used to assess a Reit’s financial leverage, is closely monitored by investors.

A low gearing ratio could point to greater capacity to undertake more debt for future acquisitions while a high gearing ratio could lead to credit concerns especially during economic downturns. SGX RESEARCH

The writer is a research analyst at SGX.

For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.