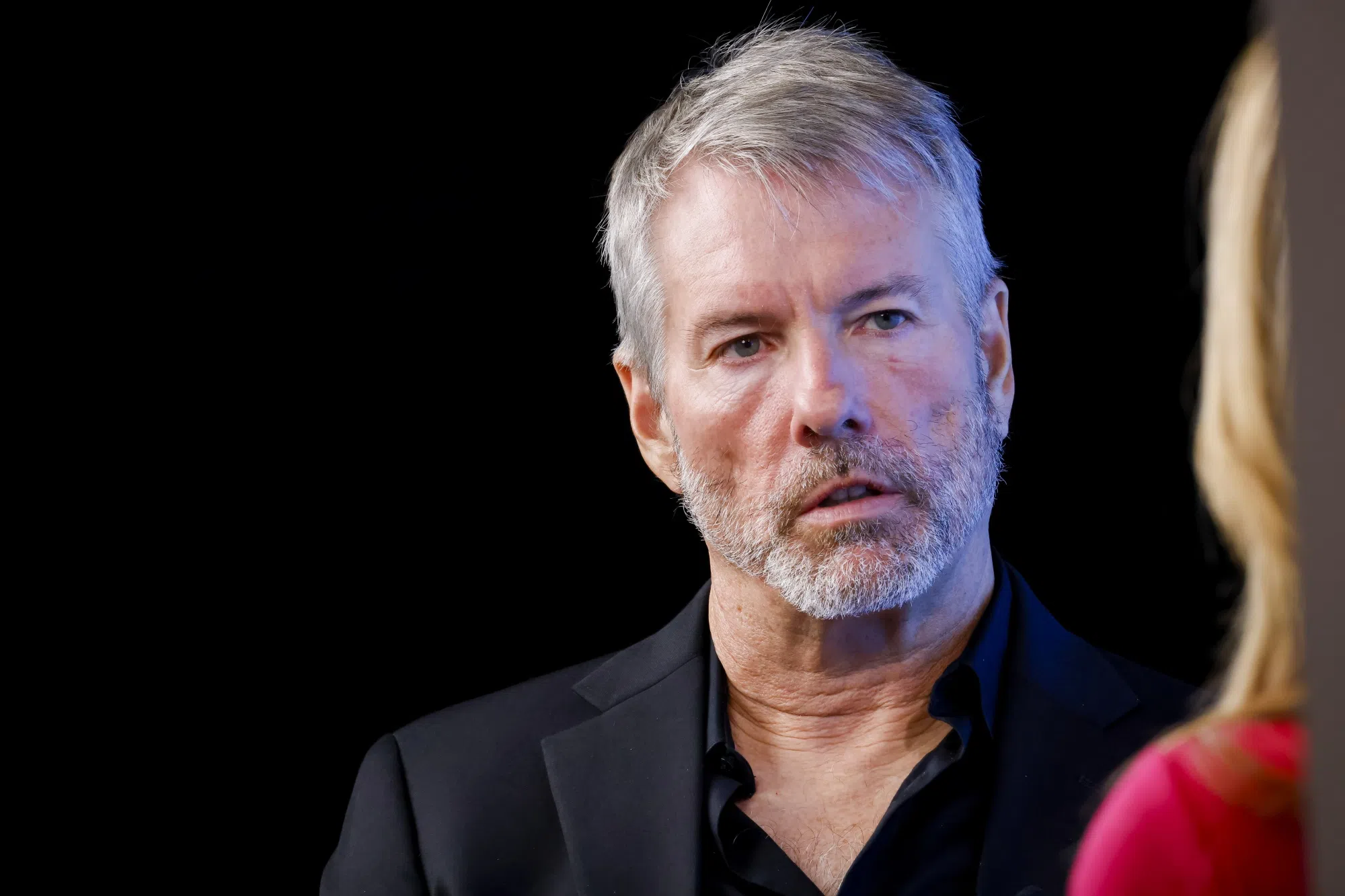

MicroStrategy’s Michael Saylor wants more ‘intelligent leverage’

MICROSTRATEGY co-founder and chairman Michael Saylor says the dot-com-era software maker turned leveraged Bitcoin proxy plans to focus more on fixed-income securities for raising capital to buy the cryptocurrency, once its current fundraising programme is exhausted.

Saylor stated the preference in a Bloomberg Television interview when asked about how he expects to fund future cryptocurrency purchases. To date, MicroStrategy has used a mix of new equity and sales of convertible bonds to finance the buying, the latter of which have rewarded owners as its stock rallied towards the price where they become exchangeable for stock.

“We have US$7.2 billion dollars of converts, but US$4 billion of them are essentially equity, they are through the strike price, the call price, and they are trading with a delta of approximately 100 per cent, they are looking like equity,” Saylor said on Wednesday (Dec 18). “We would like to go back and build more intelligent leverage for the benefit of our common stock shareholders.”

MicroStrategy has become a major investment story this year as it accelerated an unconventional plan launched in late October to raise US$42 billion solely to purchase and hold the cryptocurrency over the next three years. The firm has already sold about about two-thirds of the stock portion and around a third of the convertible debt it planned to offer.

The Tysons Corner, Virginia-based firm has announced multi-billion dollar acquisitions of Bitcoin every Monday over the past six weeks, sending its shares surging along with the token’s price – and raising questions in some circles about the strategy’s sustainability.

The firm uses regulated exchanges such as Coinbase to purchase Bitcoin, Saylor said. MicroStrategy shares have risen around 500 per cent this year, far outpacing the roughly 150 per cent gain in Bitcoin.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Hedge funds have been seeking out its fixed-income securities for convertible arbitrage strategies – buying the bonds and selling the shares short, essentially betting on the underlying stock’s volatility. This demand has helped fuel MicroStrategy’s issuance of US$6.2 billion worth of convertibles this year.

The company plans to focus more on fixed-income securities such as convertibles in the first quarter of 2025, as Saylor warns that MicroStrategy is probably getting too de-levered.

“We will revisit our capital plan and put in place a new plan subject to market conditions at the time,” Saylor said.

Even with the concerns raised about the strategy, the surge in the company’s market capitalisation to more than US$90 billion has helped to win its inclusion in the Nasdaq 100 Index at the end of trading on Friday. That may drive over US$2 billion of purchases of its shares from funds that track the tech benchmark index, according to Bloomberg Intelligence estimates.

MicroStrategy and crypto prices have been surging since the election of president-elect Donald Trump. Saylor declined to comment on whether he has met with Trump, but said he has met with a lot of people in the incoming administration. Bloomberg News has reported that the president-elect is considering creating a crypto advisory council, and Saylor said he remains open to it.

“If I’m asked to serve on some sort of digital assets advisory council, I would probably do so,” Saylor said. BLOOMBERG