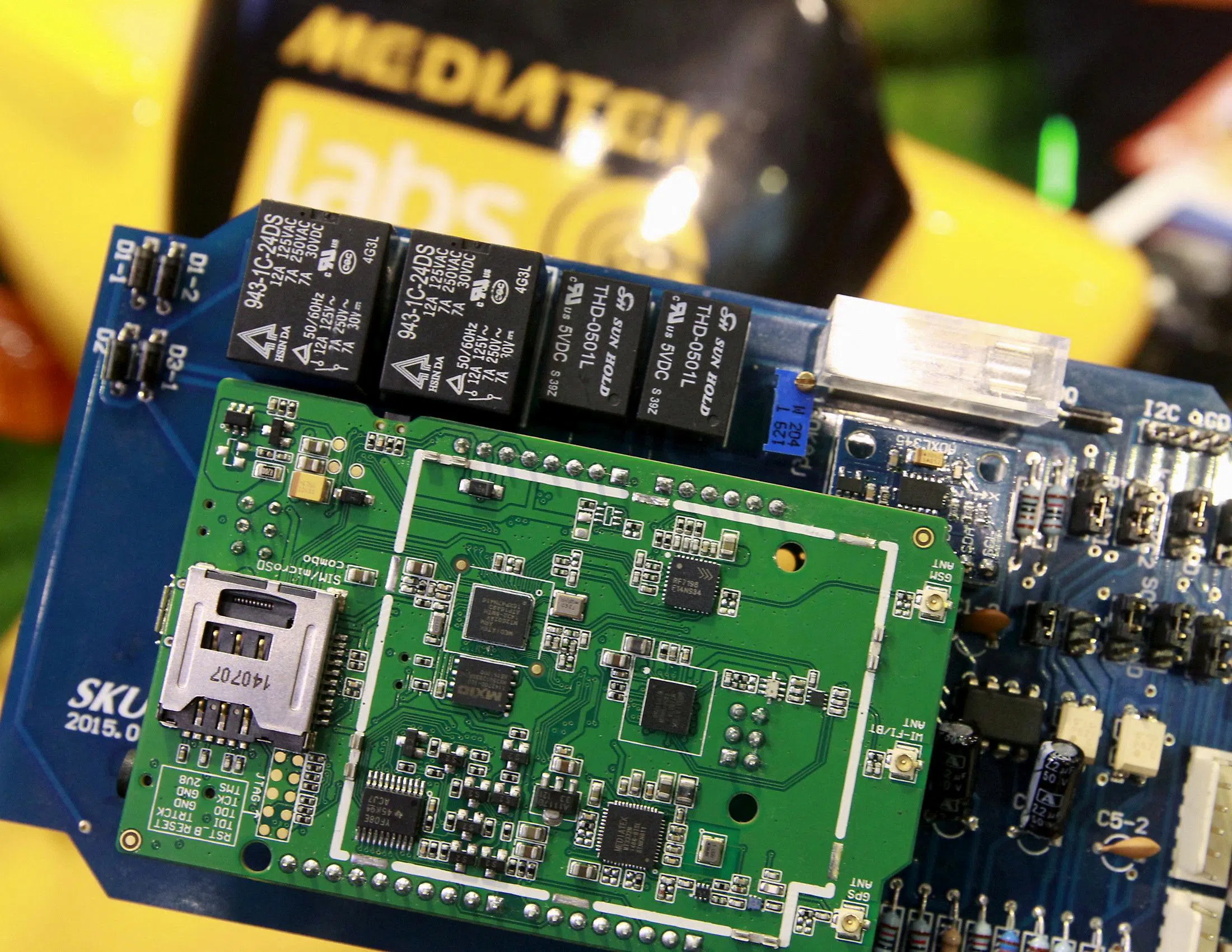

INCREASED collaboration with Nvidia has pushed investor optimism over the artificial intelligence (AI) growth potential for MediaTek to a new level, putting its shares on track for their first record high in seven months.

The stock climbed to within a whisker of its June peak this week after the Taiwanese chip designer announced a tie-up with Nvidia on an AI personal computer chip. On top of the companies’ existing partnership in automotive tech, the news helped fuelled expectations for further gains in the shares after they more than doubled in the past two years.

Known more for its key role in handset supply chains, MediaTek is now also “very well positioned for the AI tech evolution”, said Robert Mumford, an investment manager at Gam Hong Kong Limited. The projects with Nvidia and expectations for more to come show that “MediaTek has great opportunities across a diversified business set”, he added.

MediaTek is also benefiting from an improved outlook for smartphone chips, which still account for more than half of its revenue. This helped drive the consensus estimate for MediaTek’s December-quarter sales up about 5 per cent over the past few months, Bloomberg-compiled data show.

While the new PC chip is expected to provide little in terms of near-term sales given its niche customer group, overall hopes for the company’s AI-related business are high. Mumford said much of the excitement is related to the potential for application-specific integrated circuits for data centres.

MediaTek’s expertise in low-power processors, Wi-Fi and multimedia “complements Nvidia’s capabilities well”, BofA Securities analysts including Brad Lin wrote in a note. “This sets the stage for long-term upside as MediaTek expands into a wider market together with Nvidia.”

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Bears have retreated on the stock, with no sell ratings since May. Analysts have rushed to keep up with the rally, driving the average price target up 47 per cent in the past year.

Reflecting the growing positive sentiment, the shares currently trade at 20 times forward estimated earnings, above the five-year average of 16 times. That’s more expensive than the 19 times for key foundry Taiwan Semiconductor Manufacturing Company, but it pales next to the 30+ multiples for the likes of Nvidia and Broadcom.

Compared with the US giants, “MediaTek is still in discovery mode for most AI momentum flows”, said Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management. Meanwhile, the Taiwanese firm appears to be winning the AI race with handset-chip rival Qualcomm, he added.

Bao said MediaTek should benefit more from Chinese government stimulus as well, thanks to its greater mass-market positioning than Qualcomm. Beijing’s measures include limited subsidies for purchases of handsets and other smart devices.

The company’s Dimensity 8400 for high-end handsets and other chips to be released in the next few months will be key catalysts to watch, according to Morningstar analyst Phelix Lee. News on further AI tie-ups with Nvidia could also drive the shares higher.

“The next collaboration could be a Windows on Arm AI PC chip at this year’s Computex” Taipei trade show in May, Morgan Stanley analysts including Charlie Chan wrote in a note. “Given the bigger volume potential for AI PCs, we believe this would serve as another positive catalyst for the stock.” BLOOMBERG