GLOBALWAFERS is actively building out manufacturing overseas in anticipation of rising tariffs on chip materials, underscoring growing expectations that tit-for-tat trade measures will disrupt the semiconductor supply chain in the coming years.

The world’s third-largest provider of silicon wafers is expanding its factories in six of the nine countries where it operates, including two factories in the US, one in Italy, and one in Denmark.

“I believe that not only in the US but also some other countries, there will be some special tariff” in the industry, GlobalWafers chairwoman and chief executive officer Doris Hsu told Bloomberg Television. Potential tariffs can be avoided by shifting to local production, she added.

Governments around the world increasingly view semiconductor technology through the lens of national security following chip shortages during and after the Covid-19 pandemic that crippled many industries, including car manufacturing. Rising geopolitical tensions have also raised the stakes.

Geopolitics is now driving the way companies do business, according to Hsu. A turning point for the company was a bid by GlobalWafers to buy German silicon wafer rival Siltronic for US$5 billion, which fell apart in 2022 after failing to win regulatory approval.

Prior to the Siltronic bid, more than 80 per cent of GlobalWafers’s growth came from mergers and acquisitions (M&A), Hsu said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“We changed our policy because we found that it’s more and more difficult to do any cross-border M&A,” Hsu said. “That was why starting from 2022, we have expansion in six countries at the same time.”

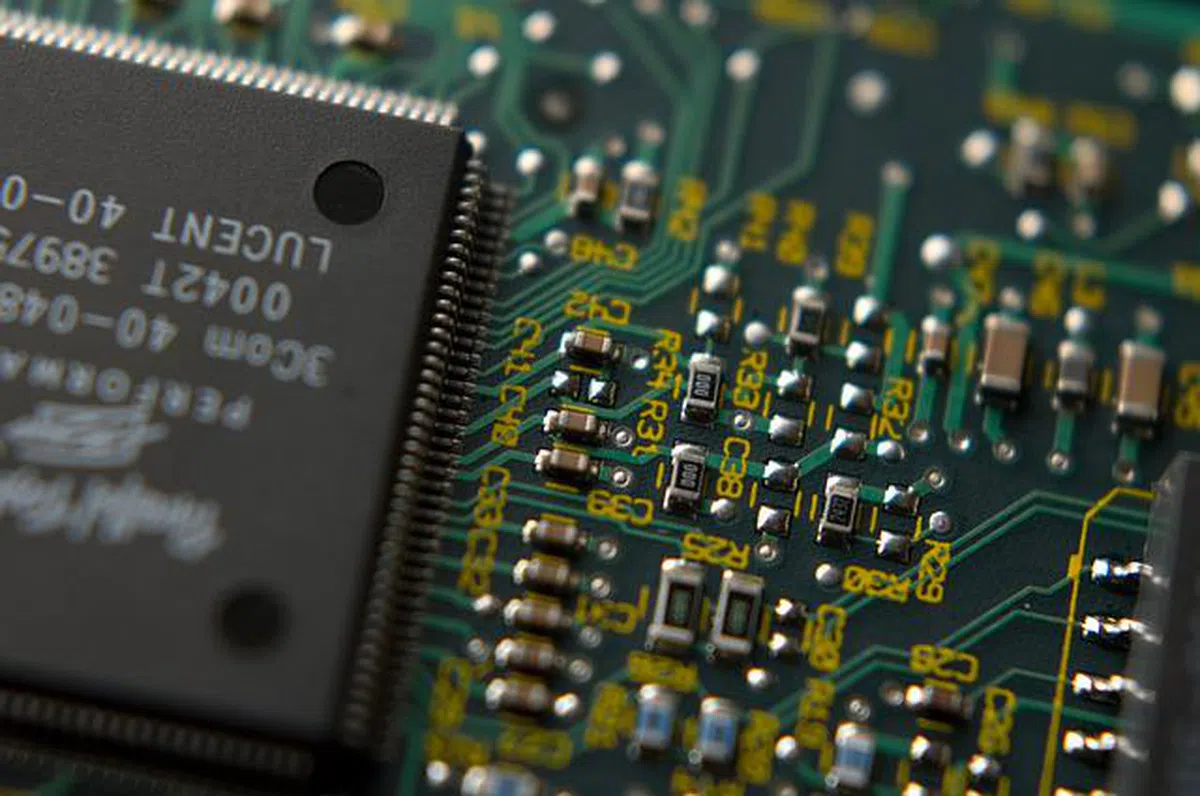

GlobalWafers, which supplies the shiny round plates from which Taiwan Semiconductor Manufacturing Company and Samsung Electronics etch circuits and slice into chips, is able to tap into some of the subsidies that countries are doling out to secure more production at home.

This year it secured a grant of as much as 103 million euros (S$149 million) from the European Commission and Italian government to build a 12-inch wafer plant in Novara, Italy. It also won US$400 million from the US Chips Act for plant expansions in Texas and Missouri that would support the creation of 2,500 jobs in construction and manufacturing.

GlobalWafers is emerging from a years-long slump in consumer electronics and car sales. The company, which has lost roughly half its market value since its peak in 2021, is hoping to ride a gradual market recovery, according to Hsu. GlobalWafers competes with Japan’s Sumco and Shin-Etsu Chemical. BLOOMBERG