Chinese investors pile into Bridgewater-style funds, eyeing Trump return – The Business Times

CHINESE hedge fund managers are racing to launch products styled on Bridgewater Associates’ popular “All Weather” strategy, to meet hot investor demand for a cushion against expected volatility during Donald Trump’s second US presidency.

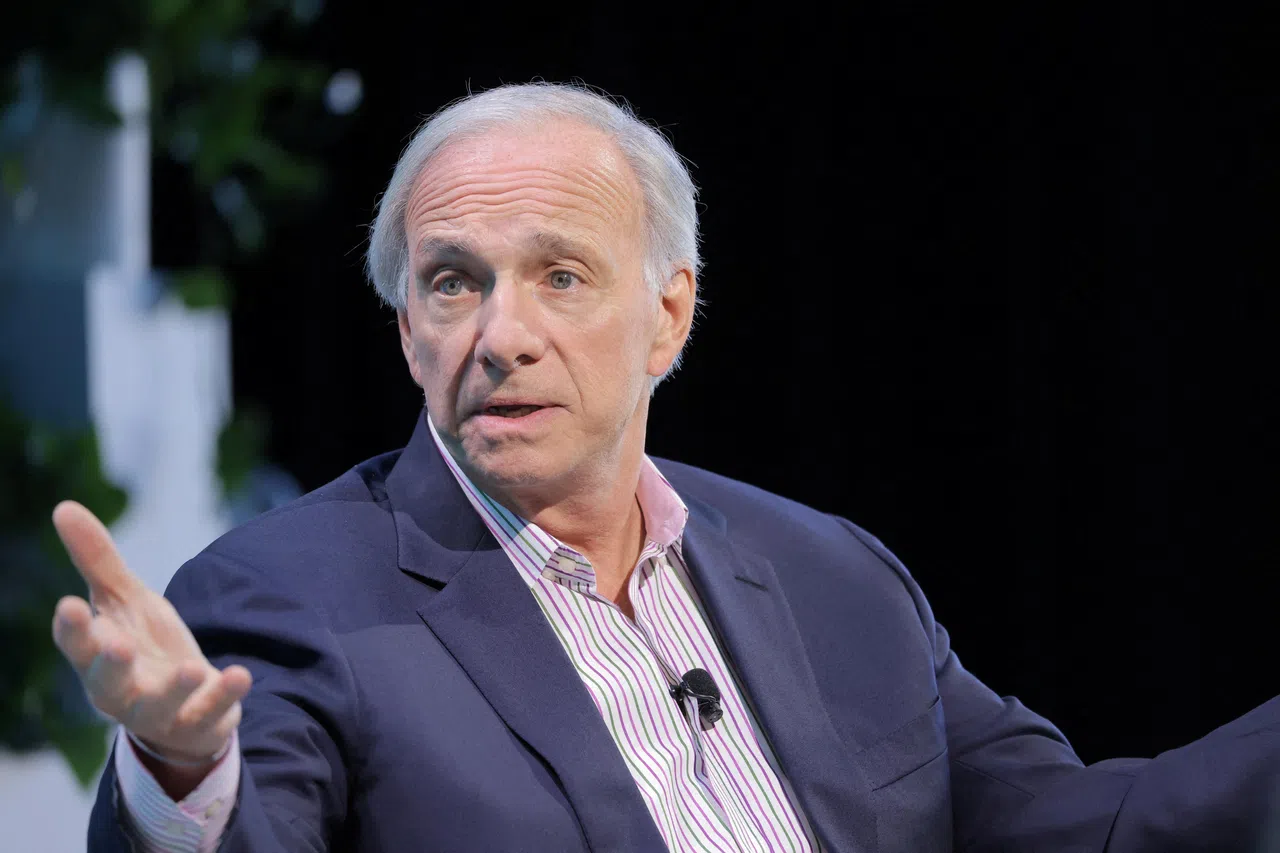

Bridgewater founder Ray Dalio’s “All Weather” is a volatility-mitigating, multi-asset strategy that helped shield its Chinese clients from the brunt of the Sino-US trade war during Trump’s first term.

The highly sought-after Bridgewater onshore China strategy eclipsed most rival hedge fund products last year with an eye-popping 37 per cent return.

Demand for the strategy has soared since Trump won the election in November and revived threats of higher trade tariffs on China. But Bridgewater has been drawing billions of yuan and had to limit the sales of its onshore funds, prompting a range of rival product launches.

At least a dozen hedge funds with “All Weather” tags that are seeking to piggyback on Bridgewater’s success have been launched since Trump’s election win in early November, picking up pace from previous months, according to official registration data.

Major local players such as SHQX Asset Management and Shanghai Luoshu Investment have also launched similar strategies.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Yin Zhengxin, head of marketing at Luoshu, which is raising money for competing products, compares the rivalry to how Tesla’s entry galvanised China’s electric vehicle industry.

“We will see local fund managers excel in All Weather strategy in the next 3 to 5 years, potentially undercutting Bridgewater’s dominance,” he said.

The opportunity has even lured global hedge fund titan Man Group, whose China unit is preparing to offer mainland investors access to its AHL TargetRisk strategy that is based on ‘risk parity’, the concept underpinning “All Weather”, according to two sources familiar with the plan.

Bridgewater did not immediately reply to Reuters’ requests for comment. Man Group declined to comment on the product plan.

Flight to safety

“All Weather” was designed by Dalio, a long-time China bull, in 1996 and diversifies investments across assets including stocks, bonds and commodities while balancing risks so that it performs well in any economic condition – boom or bust, inflation or deflation.

Bridgewater China’s “All Weather” product was launched in 2018 and proved resilient during the Sino-US trade war, the Covid-19 pandemic, and even last spring’s “quant quake” that swiped many Chinese hedge funds.

Bridgewater China managed about 40 billion yuan (S$7.5 billion) at the start of 2024 according to sources, and its assets likely ballooned further over the past year. It posted positive returns every year in the past five years despite a struggling Chinese economy.

“When future uncertainty spikes, people would have concerns putting money into single-risk assets,” said Lv Chengtao, president of SHQX Asset, one of China’s biggest commodities-trading hedge funds with over 10 billion yuan under management.

The company’s newly launched “All Weather” products drew big inflows in the second half of last year, reflecting the popularity of the strategy, Lv said.

Shanghai Quantinv Asset Management also launched its own “All Weather”-type strategy, drawing inspiration from Bridgewater, chairman Qian Cheng said.

Other Chinese hedge fund managers that have rolled out similar products include Jroyal Asset, Rongsheng Fund and Shanghai Lanyin Capital Management, according to the companies’ disclosures.

Carlos Casanova, Asia senior economist at UBP, said there has been a huge flight to safety among Chinese investors and “everyone was so worried about Trump and what would happen” after his inauguration. REUTERS